This is likely to not come as a surprise to anyone, but the light and proximity sensor market is about to enjoy some explosive growth thanks to…Samsung and Apple. Light and proximity sensors are used in mobile devices – both smartphones and tablets – and are used primarily to detect user presence, such as when users are about to hold a smartphone up to their ears, for example, as well as for assisting in optimizing displays and screen colors relative to the amount of ambient light and brightness that is present at any given time. We’ve previously noted Samsung’s huge effort to build many sensors into its Galaxy S4 as a differentiator, but both Apple and Samsung are making heavy use of these particular sensors.

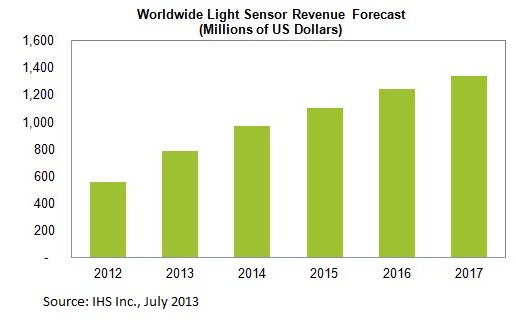

A new report from industry analytics provider HIS and its MEMS and Sensors Service points to vigorous double digit growth for the industry over the last year alone, with continued robust growth through 2017 and beyond. In terms of dollars, IHS is projecting a whopping 41 percent increase for the market year over year, with a jump from $555.1 million in 2012 to $782.2 million for 2013. This is indeed significant growth, and it clearly underscores the growth of the smartphone market itself as it continues to gain ground as the dominant new mobile device across all market segments – whether categorized by price or global region.

IHS further projects that the market will grow in double digits over the next three years. Perhaps due to the effect of smartphone market saturation longer term the company does expect growth to begin to slow down as we head into 2017, though the projected 8 percent for 2017 is still clearly significant. By 2017 revenue is projected by IHS to reach $1.3 billion. Keep in mind however that even if we see a smartphone slowdown due to saturation, these devices are also used in tablets – a mobile segment that will continue with its own explosive market growth. For the vendors in this space, the times are looking quite good.

Per IHS overall compound annual growth rate for the light and proximity sensor market from 2012 to 2017 adds up to 19 percent. The chart below points to the yearly IHS projections.

Marwan Boustany, a senior analyst for MEMS & Sensors at HIS, points out, “The continued growth of the smartphone and tablet markets serve as the foundation of a bright future for light sensors. Market leaders in these areas are driving the growth, with Apple pioneering their adoption and Samsung later taking the lead in their usage.”

This is certainly true, and Samsung itself is clearly a key driver – as we noted in our earlier article.

Many Types of Sensors

There are three key light and proximity sensor types:

Ambient Light Sensors (ALS) – These measure the different and constantly shifting intensities of the surrounding light users find themselves in when using their smartphones and tablets. They adjust screen brightness and in many cases can conserve battery power.

RGB (red, green and blue) Sensors – These measure the color temperature of a given environment by way of red, green and blue wavelengths of light. They are used primarily to help correct white balance in a device display.

Proximity Sensors – These are used for the most part to detect when users have placed their devices up to their ears (which typically occurs when users actually do something that is becoming ever more unusual with their smartphones – actually make or take phone calls!). The sensors typically disable a smartphone’s touch screen when held close to the head. This is done in part to simply avoid accidental touchscreen input but is primarily done to save battery power. Proximity sensors date back to the very first iPhone and we recall when Steve Jobs noted the capability. There is more to this collection. For example, advanced proximity sensors are now also able to interpret gestures.

An underlying reason for the projected revenue growth for the market is in the device manufacturers shifting over to more expensive sensors. In particular, there is a clear shift taking place with ALS and RGB sensors. The latter are more expensive than the former and companies are shifting to RGB and away from ALS – at least on higher cost devices. Proximity sensors with gesture recognition have similar price premiums associated with them. Again the key driver here is the higher end smartphone market.

It is certainly also well worth noting that light sensors have long been used in numerous other applications – especially for consumer electronics and PCs (e.g. laptops). Televisions, home automation, medical electronics, general lighting and the automotive space for a wide range of vehicle displays and alerts, are all applications that use light sensors. Never the less, it is the mobile market that is driving today’s new growth.

Samsung and Apple

Apple has had an interesting light sensor focus – they’ve shifted between prepackaged and custom parts over the years, but the sheer number of iPhones sold has helped to drive the segment. In 2010 for example Apple included an RGB and proximity sensor in its original iPhone 4, as well as an RGB sensor in that generation’s iPad. Apple however then dropped these sensors from the iPhone 4S, iPhone 5 and next generation iPads, instead opting to use discrete solutions consisting of individual proximity and ALS sensors. Discrete solutions can offer flexibility in the choice of sensors; combo packages cost less but the manufacturer is locked into certain choices made by the sensor manufacturers to achieve certain price points.

Apple’s huge attention to overall detail certainly is a driving force behind the use of discrete vs. combo products. It emphasizes the “premium” nature of the iPhone and underscores why Apple is perceived to be the leader in overall build quality.

Samsung, meanwhile, has gone on to use light and proximity sensors in ever larger quantities than Apple. Last year Samsung included an RGB, proximity and infrared (IR) combo sensor, for both its Galaxy S III smartphone and Galaxy Note 2 device. And this year, of course, Samsung deployed a discrete RGB sensor in its latest smartphone, the Galaxy S4, switching from a combo package due to lack of availability of a combo sensor with gesture capability. The Galaxy S4 is packed with sensors, as we noted in our earlier article. The new gesture functionality found in the Galaxy S4 is projected by IHS to see particularly strong growth over the next five years. For the industry Samsung has a very long coat tail – as it puts theses sensors into play its competitors have little choice but to jump in and do the same.

Samsung and Apple are the top buyers of light sensors – the two of them alone accounted for over 50 percent of light sensor revenue last year. Next in line following Samsung and Apple – again not surprisingly, is a collective group of OEMs from China. These include the big Chinese players Huawei, ZTE and Lenovo, but also much lesser-known companies such as Coolpad and Xiaomi.

The top sensor suppliers – and those that are clearly best positioned to benefit from the projected surge in sensor revenue are ams through its Taos unit in Texas, which supplies Apple and Capella Microsystems from Taiwan, Samsung’s top light sensor supplier. Together these two companies currently own more than half of the light sensor market. Other key sensor players include Avago Technologies from California and Sharp from Japan.

Sensors help to put the “smart” in smartphones. As the smartphone market continues to grow we can expect continued growth not only in the light sensor space but other areas as well. The old saying, “All boats rise with a rising tide” has never been truer than it is currently in the sensor market segment.

Edited by

Alisen Downey

QUICK LINKS

QUICK LINKS