Approximately 65.3 percent of backhaul operators in the United States examined the whole Ethernet backhaul to lower their costs and to differentiate their network services.

Because of the telecommunications industry’s shift to long-term evolution (LTE) and 4G technologies, the entirety of backhaul is moving to new architectures, such as Internet Protocol (IP) and Ethernet, creating growth opportunities for testing.

This migration presents a number of key growth opportunities for test equipment vendors. Developing solutions that will help manage various applications to facilitate the interoperability of mobile backhaul testing is likely to generate high growth and success for mobile backhaul test equipment vendors.

The total global mobile backhaul and wireless core test equipment market revenue reached almost $357.5 million in 2011, according to research recently published by Frost & Sullivan. It is forecasted that there will be continued growth, reaching the double-digits, in the global mobile backhaul and wireless core test equipment markets over the next few years.

The market is expected to grow at a compound annual growth rate of 15.1 percent between 2011 and 2018.

Within this study, the global mobile backhaul and wireless core market is divided into two different application segments: pre-deployment test equipment (also called the evaluation lab stage) and post-deployment test equipment, used in the field environments of customer premises.

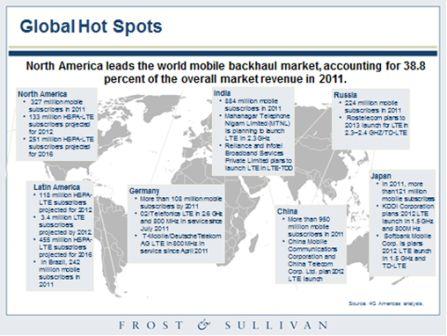

This analysis covers all the regions in the world, including North America, Europe, Asia-Pacific (APAC) and emerging markets.

The global mobile backhaul test equipment pre-deployment segment reportedly held the largest market share at 70.0 percent in the global mobile backhaul test equipment industry. Additionally, major growth opportunities within this segment comes from the emerging region and the APAC region with a CAGR from 2011 to 2018 estimated at 18.7 percent and 17.0 percent, respectively.

Major Market Prospects and Future Growth

One of the main factors driving demand for the mobile backhaul test equipment markets is the continuous replacement of time-division multiplexing (TDM) technologies into Ethernet and IP technologies. The industry is experiencing a historically high growth in mobile traffic and data, driving the need for a new set of dynamics and realignment for mobile backhaul. Within this transition, it is crucial for IP and Carrier Ethernet to stay ahead of higher bandwidth and quality-intensive service demands, such as data, voice and video services delivered over the network.

According to some leading vendors, the cost of not adopting the migration to Ethernet implies that service charges are multiplied by 30. In 2011, 65.3 percent of backhaul operators in the United States examined the whole Ethernet backhaul to lower their costs and to differentiate their network services.

For at least the next two to three years, the industry is expected to experience a combination of both E1/T1 (for voice) and Ethernet/IP (for data services) technologies in the mobile backhaul market. This hybrid-network approach has to support legacy networks and new architectures, representing some key industry challenges as it obliges carriers to sustain two separate networks. New architectures are trying to provide the same level of quality required in TDM networks.

The current level of demand is the result of the industry moving from 3G to 4G technologies and the increasing backhaul speed moving from TDM to 1G or 10-gigabit facilities. Such updates have driven testing growth opportunities because the infrastructure architecture that delivers LTE services has changed. In most scenarios, operators are examining new services that deliver a faster or higher level of quality of service (QoS). There were approximately 30 commercial deployments of LTE in 2011. It is expected that the first implementations of voice over LTE (VoLTE) will be deployed in 2012.

Worldwide mobile traffic will reach 6.3 exabytes per month in 2015, which is equal to 1 billion gigabytes. Around 70 percent of global data traffic will come from video services, which will require higher backhaul speed.

In terms of market share, Ixia led the pack in the pre-deployment test equipment segment, whereas JDSU holds the first position in the post-deployment segment in 2011.

Regional Trends Discussion

In the North American market, many investments are going to 4G, which is why there is a high growth trend in mobile backhaul to support the need for more bandwidth for 3G and 4G technologies.

High growth is expected for APAC stemming from the replacement of new deployment for network and backhaul within China, Korea and Japan. Today, China represents 32.8 percent of total APAC revenue for the mobile backhaul market. China’s average growth rate is 18.2 percent annually.

Within the European region, there are still differences between telecoms in terms of auction-band offerings. This may delay the rollout of technologies until 2013 and 2014.

In markets within the emerging region, the largest growth comes from Latin American countries, such as Brazil and Mexico. These countries have increased local research and development (R&D) spending. The leading country for the transition to LTE for Latin America is Brazil, which derives from preparation for the upcoming World Cup in 2014 and the Olympic Games in 2016.

As the industry transitions to more packed data, service assurance and quality will become increasingly crucial. There will be a need for an increase in testing to enhance customer experience. Through automation, customer education and industry-certification programs, challenges facing service providers are being addressed.

Mariano Kimbara is a Senior Research Analyst with Frost & Sullivan’s Global Measurement & Instrumentation Practice. He focuses on next generation services, monitoring and analyzing emerging trends, technologies and market behavior in the communications test & measurement equipment market, while simultaneously fulfilling customized regional consulting engagements and leading global research studies within this field.

Edited by

Braden Becker

QUICK LINKS

QUICK LINKS