A few weeks ago, we wrote an article that suggested the United States needs to get its wireless broadband act together in terms of being able to deliver enough wireless broadband capability to effectively meet demand. The general prognosis in that article was that the ability to do so is available, but that politics and other issues were getting in the way of effectively managing the spectrum allocation needed to continue to grow wireless broadband capacity.

Demand for wireless broadband continues to explode as mobile services are both readily embraced and adopted by both consumers and businesses across a wide variety of verticals. These include, but are not limited to, automotive telematics, vehicle traffic management, financial services, retail markets, and mobile healthcare. Without an adequate spectrum supply U.S. wireless networks will face capacity constraints that will place a huge drag on the U.S. economy.

Now, a new report from Deloitte, titled "Airwave Overload? Addressing Spectrum Strategy Issues that Jeopardize U.S. Mobile Broadband Leadership," speaks to the issue from a slightly different perspective - one that suggests that the United States, which has enjoyed owning the global leadership position in next-generation 4G and LTE wireless capability is largely at risk of losing its leadership position. This scenario is a possibility for two reasons.

First, Deloitte points out that other countries continue to make significant investments in mobile broadband innovation and deployment. That is to be expected, but such investments and deployments become larger in scope relative to the United States only if or as the U.S. ends up slowing down its own deployments. This is a very real scenario, and the Deloitte report pointedly suggests that a fundamental U.S. policy shift that addresses spectrum management is needed. This returns us to our original article noted above, which doesn't take into account investments in other countries but otherwise draws the same policy conclusions.

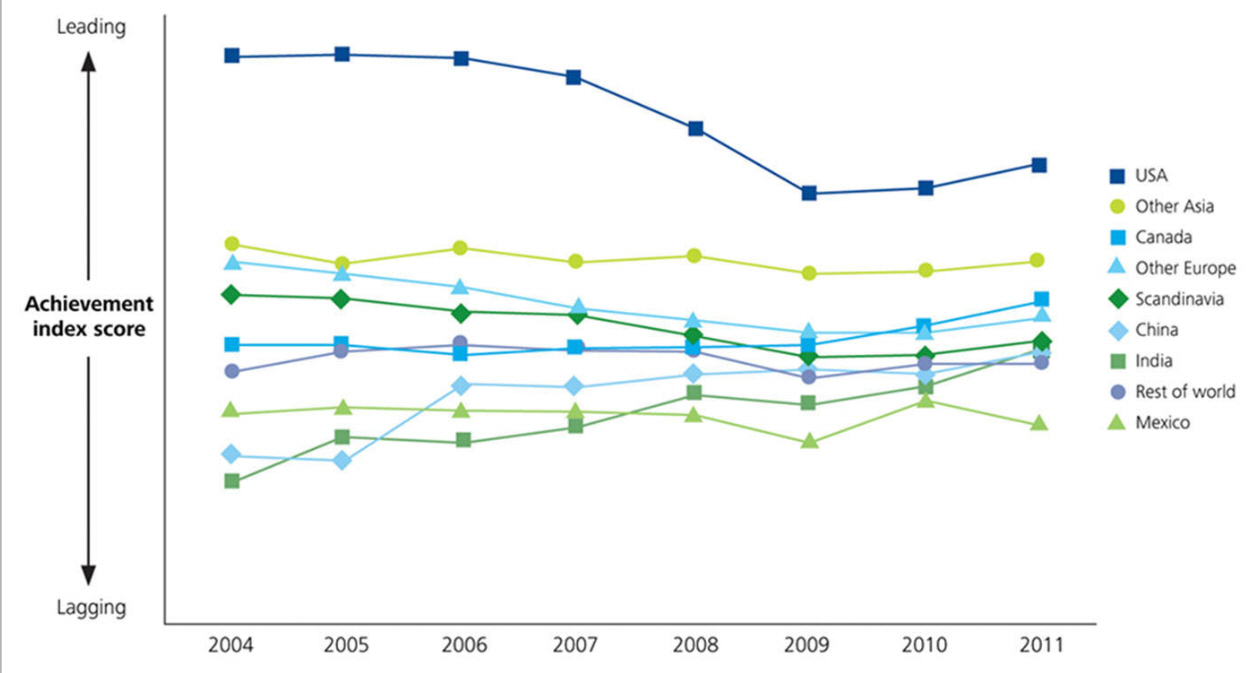

The chart below, courtesy of Deloitte, shows how Deloitte now ranks the global wireless broadband community, and why it is concerned about U.S. leadership positioning. The chart introduces what Deloitte refers to as the "Mobile Communications National Achievement Index." It uses 15 indicators to track the vitality and competitiveness of national wireless sectors in 20 countries from 2004 to 2011. It provides clear evidence of U.S. leadership but also provides clear evidence that the gap is shrinking as the U.S. annual scores declines while countries in Asia and Europe gain ground.

Wireless Broadband Leadership is about Economic Leadership

The second reason for concern is a direct economic issue. "While a century of U.S. spectrum policies has served the country well, continued accelerated investment in 4G and related technologies is required for the U.S. to retain its global lead in mobile broadband and reap the associated benefits in GDP and job growth," says Craig Wigginton, U.S. telecommunications sector leader, Deloitte LLP. "For this, the U.S. must not only head off a spectrum shortage, but show the way in adopting a policy framework that can better meet the requirements of the 21st century marketplace."

What Wigginton means by the "the benefits in GDP and job growth" is that wireless broadband growth is a strategic fundamental requirement that is necessary to handle the growth of commercial mobile services that are expected to drive a substantial portion of the U.S. economy, in turn leading to both new jobs and increased tax revenues. The Deloitte report notes that its analysis "indicates mobile broadband network investments over the period 2012-2016 could expand U.S. GDP between $73 and $151 billion, and account for between 371,000 and 771,000 jobs. Moreover, the benefits are becoming more widespread as 4G technology is applied to business enterprises in addition to consumer applications."

A failure to free up the needed spectrum for the US wireless carriers to continue to drive 4G wireless broadband availability presents a huge roadblock, one that stands directly in the way of ensuring that mobile services and the economic benefits that are expected to accrue from those services become real. A failure to free up spectrum will cost the United States GDP loss, job loss and tax revenue loss.

The report shows that despite efforts by U.S. telecom carriers to augment network capacity, mobile broadband demand growth threatens to overwhelm the system. Dan Littmann, principal, Deloitte Consulting LLP, echoes the issues brought up in our earlier article: "To secure U.S. leadership, carriers need to keep up with the surge in 4G demand fueled by a multitude of innovative devices and an explosion in applications. And to do that the carriers need more spectrum, which means finding ways for government to reallocate frequencies now used by various private-sector entities and government agencies. Otherwise, we risk losing jobs and profits to global competitors."

Adds Phil Wilson, director, Deloitte Consulting LLP added, "While the U.S. currently leads the world in mobile broadband, the aim should be to remain number one – not become one of the top ten – unfortunately policy gray areas make spectrum reorganization a threat to this lead."

The economic benefits of delivering on wireless broadband capacity is clearly not lost on the US's global competitors. The indicators in the chart above show a "clear and present danger" that the United States will lose its leadership role if the U.S. government agencies responsible for spectrum allocation don't step up and deliver what is needed.

The Deloitte report outlines the following specific fundamental policy changes that are necessary to avoid stifling US wireless broadband growth and innovation:

- Develop an official U.S. spectrum strategy aimed at resolving policy ambiguities that hamper effective mobile broadband decision making

- Treat the costs incurred in making sufficient spectrum available for commercial mobile broadband as investments with a return that is realized over time in the form of increased GDP and tax revenue

- Make a successful television broadcast spectrum auction a top priority toward meeting the 2020 goal of freeing up 500 MHz of spectrum for mobile broadband

- Expand government funded or supported R&D efforts to explore the potential of spectrum sharing as a means to boost mobile broadband capacity

- Continue to leverage traditional auctions combined with viable secondary markets to ensure not only an adequate supply of spectrum but also that spectrum is used with maximum efficiency and timeliness

- Allocate spectrum in large blocks based on technically-driven criteria to alleviate constraints caused by the crowded, fragmented legacy-spectrum zoning map

- Conduct principles-based license renewal reviews as a means to ensure that license holdings and spectrum policies are aligned with changing technological and economic realities

The Deloitte report and our earlier article both conclude that without new and effective policy initiatives to ensure adequate spectrum supply, both near term and longer term U.S. wireless broadband capacity will likely prove insufficient for growth. The current lack of spectrum availability and policies that will adequately allocate spectrum will absolutely constrain the U.S. wireless industry, the associated ecosystem and the U.S. economy in very damaging ways.

The complete Airwave Overload? report is available for download on the Deloitte website.

Want to learn more about today’s powerful mobile Internet ecosystem? Don't miss the Mobility Tech Conference & Expo, collocated with ITEXPO Austin 2012 taking place Oct. 2-5 2012, in Austin, TX. Stay in touch with everything happening at Mobility Tech Conference & Expo. Follow us on Twitter.

Edited by

Jamie Epstein

QUICK LINKS

QUICK LINKS