IHS iSuppli continues to do one of the things it does best – take apart gadgets and figure out what it all costs to actually build them. We love that they do this, and look forward to providing commentary around their discoveries. Needless to say perhaps, it has been a particularly fruitful period for iSuppli on this front, what with Microsoft’s Surface RT, Amazon’s new Kindle Fire HD and Apple’s iPad mini all hitting the final release stage with real products.

It is interesting to see what iSuppli has unearthed here. We’ll start with Amazon’s 16 GB Kindle Fire HD, move on to the 32 GB Surface RT and wrap it up with the 16 GB iPad mini. True, we could have tossed Google’s Nexus 7 into the mix here, but we’ll stick with the lineup we’ve pulled together. All photos, charts and details are from iSuppli.

Here is a snapshot before the details:

· Amazon looks to make a tiny bit money on the Kindle Fire HD entry model, using it as a loss leader to get people to its stores.

· Microsoft strikes a balance with the Surface RT between earning dollars and delivering a device with frictionless enough pricing that consumers will close the deal. The Surface RT may in fact be somewhat more profitable than the iPad mini.

· Apple looks to make as much money as possible from the iPad mini – because, well…it can.

We should note that the cost estimates are preliminary in that though they do include manufacturing cost estimates, they do not include the cost of software, licensing, royalties or other such expenditures. In addition, we have not provided iSuppli’s charts that list all parts manufacturer details. Look for links to these and additional photos at the end of the article.

Amazon Makes a Bit of Money with the Kindle Fire HD

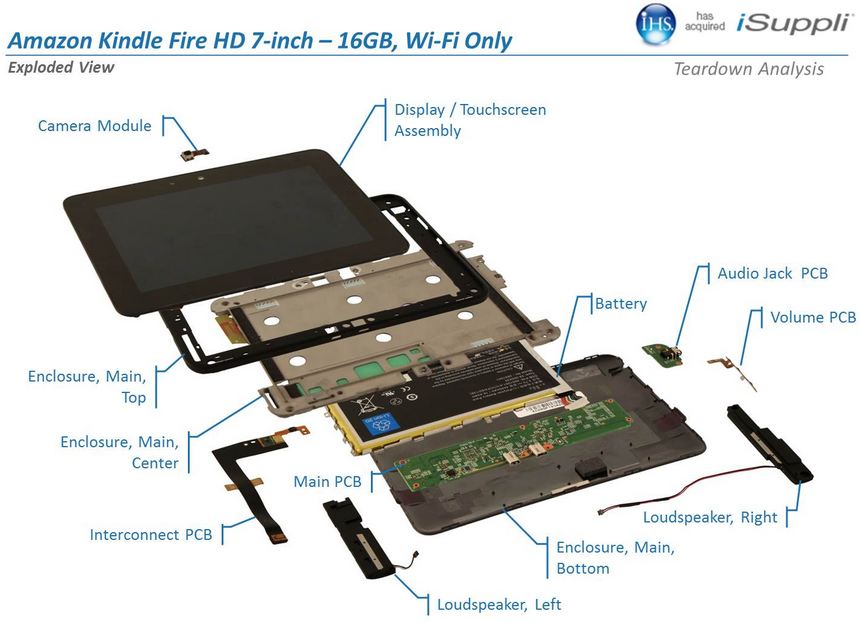

Here is what the Kindle Fire HD looks like once it is taken apart:

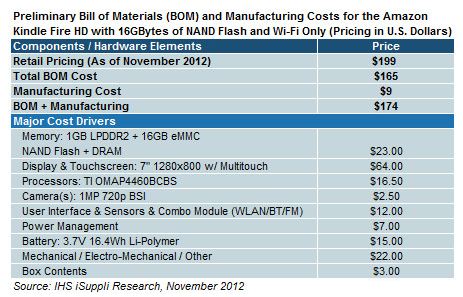

The Kindle Fire HD with 16 GB of NAND flash, Wi-Fi wireless and no cellular capability delivers a bill of materials (BOM) cost of $165.00. Adding an iSuppli-estimated $9.00 manufacturing cost brings the total cost to produce the 16 GB Kindle Fire HD to $174.00. The entire parts and price list is provided in the chart below:

At $174.00, the Kindle Fire HD costs slightly less to make than its sales price of $199.00, strictly from a hardware and manufacturing perspective and not including other costs. This is an improvement from the original Kindle Fire, which was priced the same at $199.00, but was initially estimated by iSuppli to have a BOM and manufacturing cost of $201.70. This essentially meant that Amazon actually recorded a loss on every Kindle Fire sale. This subsidy was a tradeoff that Amazon was willing to take in order to get its customers to its stores.

This time around, Amazon has managed to make things a bit better for itself, even though it will continue to view the Kindle Fire HD as a loss leader with a primary job of getting people out to Amazon’s stores. That Amazon can now at least also “make a couple of bucks” on its loss leader speaks well of Amazon. The company has managed to reduce the Kindle Fire HD’s BOM not by downgrading the device but by in fact actually improving it compared to the original Kindle Fire. Yes, most of the improvements are absolutely of the incremental sort, but improved specs and a tiny profit rather than a cost for moving customers is still a non-trivial improvement. What key things changed for the better?

· Amazon improved the display– from 1,024 x 600 to 1,280 x 800. Yet the display turns out to be the largest area of cost reduction - a $23.00 decrease in the BOM compared to the orginal Kindle Fire.

· The display and touchscreen subsystem costs a total of only $64.00, accounting for 39 percent of the Kindle Fire HD’s total BOM. In contrast, the original Kindle Fire’s display and touchscreen carried a cost $87.00 and accounted for 47 percent of the original's BOM.

· The memory configurations in the Fire HD also doubled compared to the original Kindle Fire. NAND flash increased to 16 GB from 8 and DRAM content rose to 1 GB from 512 MB. Yet, total memory cost in the Kindle Fire HD is $23.00, so that a combined doubling of memory only cost Amazon $1.00 more than the original.

· An upgrade of the Kindle’s Texas Instruments processor from the 1 GHz OMAP4430 to the 1.5 GHz OMAP4460delivers an increase of less than $2.00 in BOM cost.

· The battery is unchanged but the cost of the battery declined to $15.00, down from $16.50.

· The new Kindle adds a camera module, albeit a pretty bad one that offers 1 MP of resolution at a cost of $2.50. This compares to $11.00 for the combined cost of a 5 MP rear camera and a secondary 1 MP front-facing camera on the iPad mini.

As does Apple, other models of the Kindle HD Fire with either more memory or larger screens cost the consumer much more than the incremental costs of the upgrades. When users look to buy beyond the base $199 model Amazon does quite well for itself on overall margins – and yet the goal remains the same: get the consumer to the Amazon stores. And the Kindles do exactly this.

Microsoft Scratches the Surface of its Tablet Possibilities

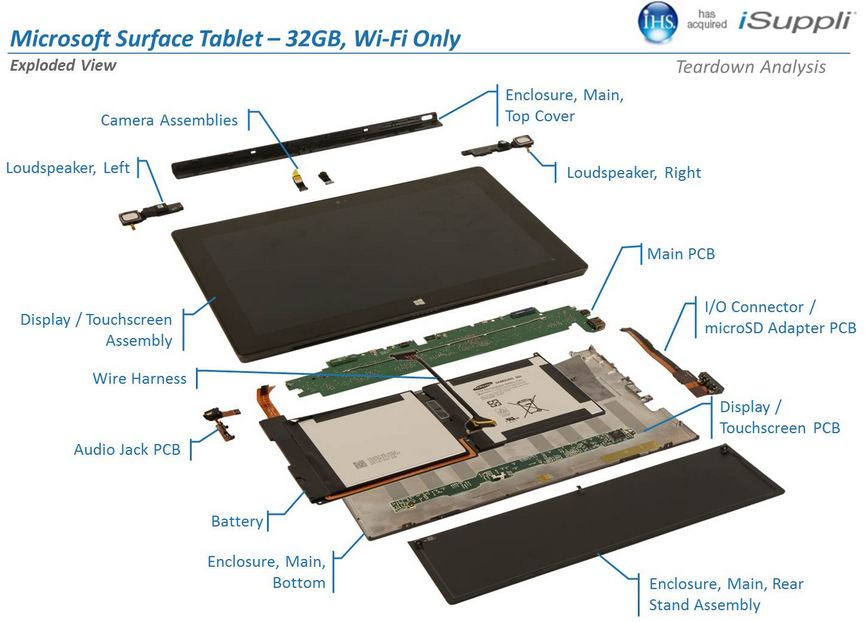

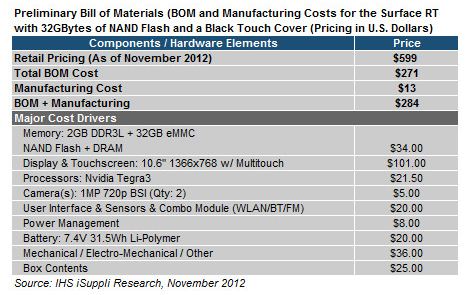

Microsoft’s Surface RT entry level model with the 32 GB of NAND flash memory and an optional Touch Cover carries a BOM of $271.00. With an estimated $13.00 manufacturing expense added in, the total cost to Microsoft for the Surface RT is $284.00. Below is the view of a totally disassembled Surface RT.

In terms of its overall size (which is somewhat larger than the iPad), feature set and the price threshold suggested by the BOM, the Surface RT is clearly designed to compete with the full-sized iPad. We’ve previously looked at how the Surface RT and its yet to be released sibling the Surface Pro compare with the various available iPads from a display perspective. It is interesting to see how the underlying costs square up against each other. Below is the full parts breakdown and cost analysis for the entry level Surface RT.

At the estimated total BOM and manufacturing cost of $284 and a retail price of $599 with the Touch Cover, the Surface RT generates hardware and manufacturing profits that in fact are, in percentage terms, higher than the low-end iPad 2. Even at a price of $499 without the Touch Cover, Microsoft will generate a profit margin that is greater than the iPad 2, in both percentage terms and on a per-unit basis. We should note here that Microsoft includes the Windows RT version of Office at these price points, which actually makes the Surface RT a potentially outstanding deal for those among us who are Office devotees.

Perhaps the most impressive piece of the entire Surface RT package is the keyboard, which will cost consumers, at least initially, $100. But it costs Microsoft almost nothing - $16 to $18 according to iSuppli - to actually manufacture them. By adding Microsoft Office to the base $499 machine, the company delivers that absolutely “frictionless” pricing we often talk about, yet sets the consumer up for the impulse buy – that “yeah, OK, throw the keyboard in as well” deal that all of Microsoft’s store employees will be keenly focused on.

The iPad mini – When Price Doesn’t Need to be Frictionless

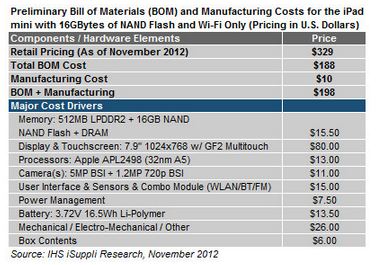

The base model of Apple’s new iPad mini with Wi-Fi only and 16 GB of NAND flash memory, carries a BOM of $188.00. With an estimated manufacturing cost that iSuppli pegs at $10.00, the total cost to Apple to manufacture the iPad mini rises to an estimated $198.00. Below is a view of the disassembled iPad mini.

Based on the ratio of cost to retail price, iSuppli estimates that the iPad mini is just a bit more profitable on a percentage basis than a comparably equipped new iPad, based on the new iPad’s BOM when it was released in March 2012. Below is iSuppli’s summary of all the parts that make up the iPa mini, along with their associated costs.

With the entry model of the iPad mini pegged at $329, Apple is clearly not worried about pricing issues. In fact, Apple is clearly mocking the “mythically magical” price point of $199 that Amazon’s Kindle Fire HD and Google’s Nexus 7 have set for their entry level price point. Clearly Apple is not concerned. Although the iPad mini sports a larger display – measuring 7.85 inches diagonally rather than the 7 inches Amazon’s and Google’s sport, the price differential is far larger than such a display size difference would lead to. In fact, the iPad mini display is inferior to the competitors.

Adding to the premium entry level model pricing is Apple’s usual (for both iPads and iPhones) $100 mark up for doubling memory - $429 for 32 GB and $529 for the 64 GB versions of the mini. With the cost of adding double the memory almost completely trivial, Apple makes an enormous profit on any scaled up model of iPhone and iPad. The mini is no exception.

We should note here that Microsoft provides an SD slot on the Surface RT, which easily allows consumers to increase memory capacity. Apple provides no such capability and locks users into having to buy the much more extensive models. It’s a great business if you can get the business – which Apple continues to do. Witness that it has already sold 3 million minis, with estimates of a minimum of 5 million – and likely much more than that – to be sold before the holiday season comes to a close.

Adding cellular capability is no different than buying models with more memory. Based on its teardown analysis, iSuppli estimates that the addition of the 4G LTE module hardware would cost approximately $34.00 (though this cost excludes essential intellectual property (IP) licensing fees, such as those for CDMA/WCDMA/LTE wireless technology). We’ll leave readers to do the math, but that is just our simple way of noting that cellular adds additional large chunks of profit to Apple’s coffers every time it will sell one (once they hit the stores). Apple would love nothing more than to sell you a 64 GB LTE version of the mini – at enormous profit to itself.

The iPad mini employs GF2 multi-touch touchscreen technology, which allows the touchscreen module to be thinner than competing tablets. However, the new GF2 technology also makes manufacturing more challenging during initial production by reducing manufacturing yields. This definitely drives up the price of the touchscreen module. In fact, the cost of the display and touchscreen module is estimated at $80.00, which represents a huge 43 percent of the total BOM for the entry model iPad mini. Yet despite the cost, the screen resolution falls short of the Kindle and Nexus.

Apple believes that consumers won’t care, that the display will be more than good enough. Apple will also point out that the resolution is pegged to the iPad 2, meaning it will run all 250,000 or so iPad apps in the Apple app store unchanged. Developers can only applaud this.

With the high price of the display module, Apple needed to reduce expenses in other sections of the iPad mini. This absolutely explains the use of the now old A5 processor chip, which is manufactured with a 32-nanometer process technology. The A5 only costs $13.00, and accounts for only four percent of the total BOM. This compares to $16.50 for the Texas Instruments processor used in Amazon’s Kindle Fire HD.

In Summary

Although the BOM for each of the gadgets presented here offer significant swings, each is essentially justified by the underlying business models Amazon, Microsoft and Apple are following. Amazon’s model clearly works – the Kindles do indeed drive traffic to Amazon’s stores – where the real Amazon revenue sits.

We really like how Microsoft has packaged the Surface RT – in particular the BOM to Microsoft Office tradeoff will make this an easy sell for Office users. And we believe that Microsoft will indeed get that impulse buy on the Touch Cover.

Finally, Apple continues to execute on the business model that has now proved so successful for an extended period of time – dating back to both the original launch of the iPad and the launch of the iPhone 4S.

As we’ve noted elsewhere – and often – Apple is no longer in a position to raise the bar. The iPad mini is an excellent example of this. Apple can still rely on “Apple product cachet” to seal the deal with consumers, but that model will soon stop working as the likes of Amazon and Microsoft begin to solidify their own positions and market segments – which Apple hasn’t had to deal with. The Apple mini will prove profitable, but Apple now needs to do something entirely new. 2013 will be a very interesting year.

For now, however, on to the 2012 holiday buying season.

Below are links to more iSuppli teardown details.

· Additional information for the Amazon Kindle Fire HD teardown.

· Additional information for the Microsoft Surface RT teardown.

· Additional information for the Apple iPad mini teardown.

QUICK LINKS

QUICK LINKS