The latest ComScore data for April 2013 is now in hand, and as Apple has managed to do throughout Q1 2013, it has not only continued to maintain its U.S.-based smartphone lead over Samsung and all other competitors, but has in fact increased its share of the market. ComScore’s MobiLens service tracks mobile usage and consumer mobile behavior across the U.S., European, Japanese and Canadian mobile markets. MobiLens data is derived from an intelligent online survey of a nationally representative sample of mobile subscribers aged 13 and older. Data on mobile phone usage refers to a respondent’s primary mobile phone and does not include data related to a respondent’s secondary device.

ComScore looks both at both hardware OEMS as well as platform statistics. The OEM category is the best apples to apples comparison of how Apple is doing relative to its direct hardware competitors. It is here that we can see how Apple is doing relative to Samsung, HTC and so on.

The platform numbers compare how the mobile operating systems are doing. It is an interesting measure that still allows for head to head competition in the cases of Apple and BlackBerry, but it aggregates all data or multiple OEMs in other cases. For example, Google’s Android encompasses most of the smartphone vendors – including Samsung and HTC, and essentially pits this aggregated number from multiple vendors (gathered under “Google”) against Apple and Blackberry. Windows Phone 8 is similar to Android as it also involves aggregated numbers (gathered under Microsoft).

Regardless of which way the overall pie is measured, Apple did better than any other competitor even though there continues to be a lot of noise about Apple losing market share. We do need to keep in mind however that the numbers do not reflect the impact of the Samsung Galaxy S4, LG’s new devices or the hot HTC One – HTC’s flagship device and a decidedly very cool smartphone competitor.

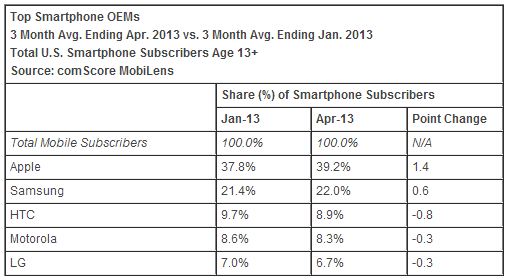

Let’s take a look at the OEM numbers first. These are shown immediately below.

Although Samsung managed to eke out a small .6 percent gain - from 21.4 to 22 percent, Apple handily beat it by increasing share from 37.8 to 39.2 percent, a gain of 1.4 percent. Given overall market dynamics, the buzz that Samsung had created around the Galaxy S3 and the well done and well coordinated advertising and marketing blitz Samsung had unleashed, it’s hard to believe the numbers have fallen as they have. Keep in mind as well that Samsung’s numbers include many different phone models. The MobiLens numbers do not show an exact comparison of Apple’s iPhone vs. the high end Galaxy S3.

Not surprisingly, HTC lost .8 percent share, although quite honestly we might have predicted this number would be even greater than it is given very recent issues with HTC. LG and Motorola also measures downticks but we don’t consider these to mean much – they can just as easily uptick the same amount next time around. We’ll ignore the legacy Symbian numbers. In any case clearly Samsung and Apple so completely dominate the market or hardware in today’s world that the others’ numbers almost don’t matter.

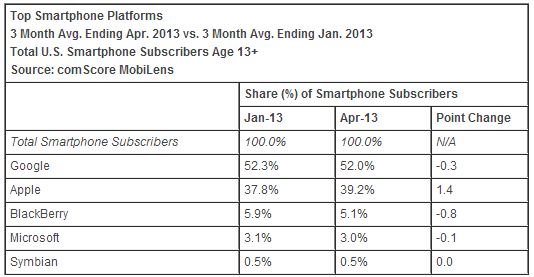

Shown below is how the platform numbers shake out.

The numbers for Apple of course remain the same and show the same 1.4 percent in growth. Google, through its multivendor aggregated numbers retains the overall market share lead but this time around Android has in fact lost a bit of share, dropping from 52.3 percent to an even 52 percent of the market. This reflects the overall loss of share between HTC, Motorola and LG.

BlackBerry’s market share dropped even though April certainly reflects the new Z10 device getting into the marketplace. The newly announced Q10 – regardless of how primitive it feels to some of us, will likely skew those numbers in the other direction before the year is out – there are a great many real keyboard BBers out there.

We are surprised by the decline in Windows Phone market share. True, a .1 percent drop is nothing more than a rounding error, but other research from other players has continued to show small but consistent ongoing growth for Windows Phone. The Nokia Lumia 920 and 820 devices certainly have been available long enough to have had an impact in April 2013, but it doesn’t appear to be the case here.

As we noted earlier, the numbers do not reflect the new and very high end devices that went into play in May 2013 – we can expect Android, Samsung and likely HTC to show some positive share gains next time around. Samsung could conceivably hit the numbers out of the park.

Finally, with Apple’s World Wide Developers’ Conference about to take place, we can expect a slew of new announcements from Apple. This is something to look forward to as far as hopes for innovation is concerned, but it also means that once Apple makes its announcements the company will likely dampen demand for older Apple products – at least in June and July (though this is dependent on when any new iPhones will actually ship). We do not expect the charts to look the same over the next few months – in fact Android collectively (Google) and Samsung are likely to make substantial gains for several months, at least until Apple’s new products get themselves fully into the pipeline.

For Samsung the numbers will definitely tell a story, likely a very positive one. For Apple though, it will once again be the critical holiday buying season that will provide the demarcations for success or failure. We’ll continue to scope the MobiLens numbers out but the real numbers that will matter the most will be those we see early in 2014.

Edited by

Jamie Epstein  QUICK LINKS

QUICK LINKS