It seems it was only yesterday that those of us in the mobile industry were wondering not about when but if smartphones would ever truly take over as the primary mobile device for both consumers and workforces. The question has of course long become moot, and today we hear more about smartphone saturation than issues of market share compared to feature phones. That said, the truth of the matter is that the smartphone market is really only saturated in so far as those predisposed to buying one already make up the existing market.

The truth of the matter is that there is a huge population of users who still have not committed to smartphone use, and this represents significant untapped opportunities. This population consists of a variety of groups – value-conscience individuals who may not see the value in smartphones, older folks (think of your parents) who are assuredly not technophiles and who don’t desire anything more than a simple means to make a phone call.

And everything in between. The key challenge in tackling this large population of potential smartphone users, according to research firm Analysys Mason’s just-released “Connected Consumer Survey 2013,” is that the group as a whole is made up of very disparate audiences. These audiences present significant differences in both demographic and purchasing habits to their smartphone-buying counterparts, and in turn they represent significant challenges for carriers who want nothing more than to convert them all to smartphone use.

Image via Shutterstock

As the report notes and as we all know, smartphone penetration in both the United States and Europe is quite high and continues to grow. But today’s growth is far different and much more incremental than it has been over the last three years or so – a period of time in which smartphones rapidly moved to become the dominant mobile device force from a product perspective. Thank you Apple and thank you Samsung – both companies are primarily responsible for this growth.

The survey group that Analysys Mason pulled together is considerable and large enough to make its conclusions highly reliable. The survey panel consisted of 6,610 individuals aged 18 years and over, and was representative of the demographic characteristics of Internet users in each country that participated – France, Germany, Poland, Spain, the U.K. and the U.S.

Respondents were selected until nationally representative quotas for gender, age range and employment status - as well as geographical region in the case of the U.S. - was reached. Respondents were asked to complete a 20-minute questionnaire that took the form of yes/no, multiple choice, text and numerical questions.

Let’s see what - at a fairly high level - the analysts at Analysys Mason uncovered.

- Smartphone adoption is approaching saturation among the contract user base and among those aged 18 to 24

This is a key issue. Fifty-two percent of respondents with a mobile handset had a smartphone, making smartphones the dominant device category on operator networks. A 52 percent share overall is not exactly what we would define as market saturation – there is obviously plenty of room to grow the smartphone market. However, it is also the case that smartphone share of new handsets (which Analysys Mason defines as those devices purchased in the last six months) looks to be declining in France and Spain, which also happen to be the markets where overall smartphone adoption is the highest.

This suggests an early indicator of market saturation. It is worth pointing out that this still leaves lots of upside in the other countries covered in the research, but think of it as a leading indicator of where these other countries will also soon end up. This statistic underscores that the saturation point for smartphones is not represented by the total number of available subscribers who can buy smartphones, but rather by those who are predisposed to buy smartphones.

The emergence of both cheaper smartphones and attractive subsidies from operators for new contract subscribers, meanwhile, has driven significant smartphone adoption in younger age groups. In fact, the percentage of respondents aged 18 to 24 who now own or regularly use a smartphone increased from 64 percent in October 2011 to 77 percent in October 2012.

Clearly this segment will eventually reach 100 percent and as this population ages the entire saturation point will in fact begin to move up towards 10 percent of all potential subscribers. But this is also going to be a slow process that will require over a decade of ongoing population shifts as today’s youngsters become tomorrow’s older populations. The immediate challenge for the wireless carriers isn’t about converting this group, but rather becomes one of finding ways to move the saturation point from its current 52 percent to something much higher.

This leaves a very interesting 48 percent of the overall global population that currently does not have a smartphone and that currently does not show a desire to do so. Operators will need to focus on these non-smartphone users. Some of them are older users, but others are not, which makes it more challenging for the carriers to find and strike the right balance that will move all subscriber base segments forward. The next major data point underscores the challenge.

- 40 percent of non-smartphone users indicated that their next handset will not necessarily be a smartphone, even if prices come down

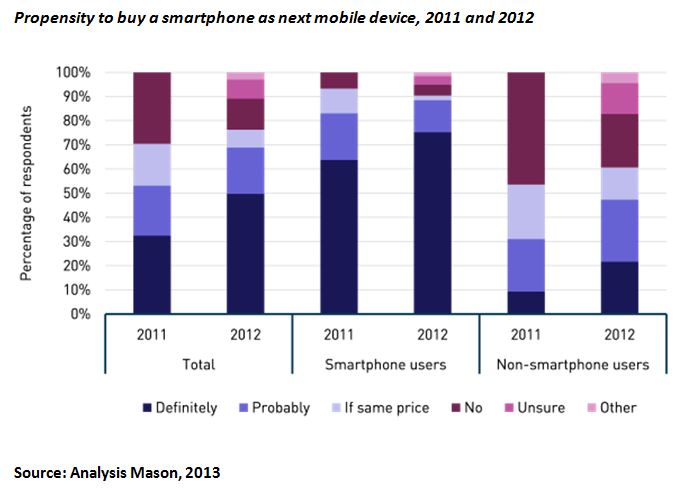

A further critical point is that the 40 percent of subscribers who indicated that they do not plan to purchase a smartphone - or who are at the least unsure whether they will do so or not - will not be swayed by price. That is, even if a smartphone costs the same as a non-smartphone they are not likely to switch. Price, in fact, is much less frequently cited as a barrier to purchasing a smartphone in this year's survey, compared to last year's results.

There is good news here in any case - the likelihood of non-smartphone users to buy a smartphone continues to increase, with nearly half of those survey respondents who don’t currently use a smartphone indicating that they would definitely opt for a smartphone for their next handset purchase. This compares to only just over 30 percent of this same group making such a claim last year.

Part of the problem in getting non-users to convert is found in the underlying data plans in effect. For example, a large majority of non-users - 61 percent - were on prepaid or SIM-only subscriptions. Only 36 percent of smartphone users are on such plans.

Finally, there is no doubt that those who do not own a smartphone are also older subscribers. Fifty percent of non-smartphone users are older than 55. Only 17 percent of smartphone users fall into this older age group. Finally, the survey research indicates that 42 percent of non-smartphone respondents have had their devices for more than two years, compared to only 7 percent of smartphone respondents.

It is hard to say at what point non-users are likely to go to the store and make the move to smartphones by their own volition – clearly the number is not encouraging. It is safe to say that the non-user population is in need of prompting to make the move a more likely one.

The chart below, which underscores trending between 2011 and 2012, also provides a good overview of how subscribers are likely to evolve.

The significant differences in demographic and purchasing habits between smartphone users and non- users present a challenge for the wireless service providers - especially those that are overtly looking to upgrade their non-smartphone customers. Some of the challenges pointed out by Analysys Mason are as follows:

- Handset subsidies do not serve as an incentive in the prepaid and SIM-only market

- App-focused marketing campaigns that appeal to younger users will not necessarily be useful in targeting the non-smartphone users, many of whom are older than 55

- Device-leasing plans - such as Vodafone Red Hot, which target lower-end customers who want the hottest smartphones - may not be particularly interesting for an older demographic

That brings us to Analysys Mason’s last point on this.

- Operators must get creative about promoting smartphones to the remaining lower-end and older subscriber base

A high share of non-smartphone users on prepaid or SIM-only subscriptions are likely to be attracted by low-end packages that are usually not available on smartphone tariffs. Operators still need to educate non-smartphone users – particularly older ones – about the benefits of owning a smartphone and about how mobile data tariffs are structured, in order to avoid bill shock.

Recent innovative operator approaches include offering to pay-as-you-go SIM customers the chance to purchase packages of more data than the token amounts that were previously available. This could encourage more prepaid subscribers to adopt low-end smartphones in order to make best use of the data.

Non-smartphone users continue to attach a lot of value to voice and messaging services, which operators must consider when trying to promote smartphones to these consumers. For example, pre-loaded over-the-top (OTT) communications or social networking apps could be used as an incentive, whether provided by the operator or by a third-party player. Operators may also be able to convince non-smartphone users to upgrade to a smartphone by providing rewards in the form of free voice and messaging credits.

Our on two cents on all of this is that there is probably a 25 to 30 percent segment of the population that simply has no need or desire to convert to smartphone use, and likely won’t even if they were offered free high end smartphones (e.g. an Apple 4S or a Samsung Galaxy S III). Wireless carriers will quickly reach points of no return for the efforts with this group.

Underlying this group’s resistance is also the issue of whether or not younger folks they associate with (e.g. their children) are interested in moving resistant parents over to smartphones. It’s a touch and go scenario - parents may ultimately be “pushed” into making the switch, but they are likely not to become active users. Similarly, subscribers who are cost-sensitive are not likely to use their smartphones in the interest of saving money.

Alas, at the end of the day, it is the active use of data services that brings in the carrier dollars on the smartphone front. A smartphone that isn’t actively used is fairly useless to the carriers from a revenue perspective. The carriers will have to acknowledge this and resign themselves to the fact that not everyone who isn’t 18-24 years of age will become reliable revenue generators.

That still leaves plenty of smartphone conversion upside. It will be interesting to see what Analysys Mason reports next year.

The full Analysys Mason report, “The Connected Consumer Survey 2013: Smartphones, Mobile Data Access and Monetization,” is available for purchase through the company’s website. It is targeted at very large businesses – be prepared, it carries a price tag of $4,999 for a one-off purchase.

Edited by

Alisen Downey  QUICK LINKS

QUICK LINKS