A new report from usually reliable Juniper Research, Smartphone Futures: Differentiation Strategies & Emerging Opportunities 2013-2018, has just been released. Why did we add the qualifier "usually reliable" to that sentence? We'll get to that later. First, let's see what Juniper has to say - or rather, suggest for the state of mobile operating systems over the next five years.

The company's analysts now believe that the smartphone mobile operating market will see new emerging players, noting that such entries as Asha, Sailfish and HTML 5 based OS players are beginning to gain ground in certain niche mobile areas. This is certainly true and there is hardly disputing any of this. We might also add Tizen to this list as a Samsung option and the mobile version of Ubuntu.

Juniper argues that these new players will take away important niche markets – especially those emerging markets where cost innovation is likely to be a huge issue for an entirely generation of smartphone users. Juniper also notes a very interesting new possibility for the mobile market - the idea of much more directly employing local knowledge as part of implementing and deploying new smartphones with these new mobile operating systems.

Let's dub this last idea "hyper-locality" (just to be clear, that is our word, not Juniper's). We are currently reading through a new report from JDSU (stay tuned on this) that points to the market for location insight growing to $11 billion. Although JDSU refers to a large umbrella issue (gaining and applying insights from truly knowing what is going on around a given person's location at any moment in time), Juniper's hyper-locality refers more specifically to understanding the local customs and behaviors of people living within specific geographic locations - and even more specifically focusing on these issues on a very small state - say from town to town. Both will be critical to dramatically increasing the effectiveness and value of data services.

Juniper suggests that the emergence of a new generation of mobile operating systems will provide device manufactures and wireless services providers with a key edge - the ability to fine tune and craft devices on a hyper-local level. Well, we certainly believe that this is a very worthy goal and one that will no doubt become a reality. On the other hand, we're very far from being convinced that you need these operating systems for accomplishing any of this.

Leaving aside Apple, which will focus on global hyper-locality in its own unique way, there is no reason to believe that either Android or Windows Phone won't provide these same capabilities for the device manufacturers and wireless service providers. To some degree cost may prove to be a factor on the Windows Phone end in favor of one of these emerging operating systems, but we hardly believe that Android will stand in the way on cost issues.

The simple idea of moving to alternative mobile operating systems beyond the major players seems tempting at 30,000 feet, but from the feet on the ground reality of deploying alternative operating systems we end up with the key issue of having to support them ongoing across potentially numerous cheap smartphone models. To a large degree, even the heft and might of Android's overall market share cannot avoid this issue. Once a vendor goes down the path of alternatives the odds increase a great deal that support costs will grow significantly - and these costs will, in turn, eventually have ot be passed on to consumers. It ultimately becomes a self-defeating vicious circle.

Apple and Samsung

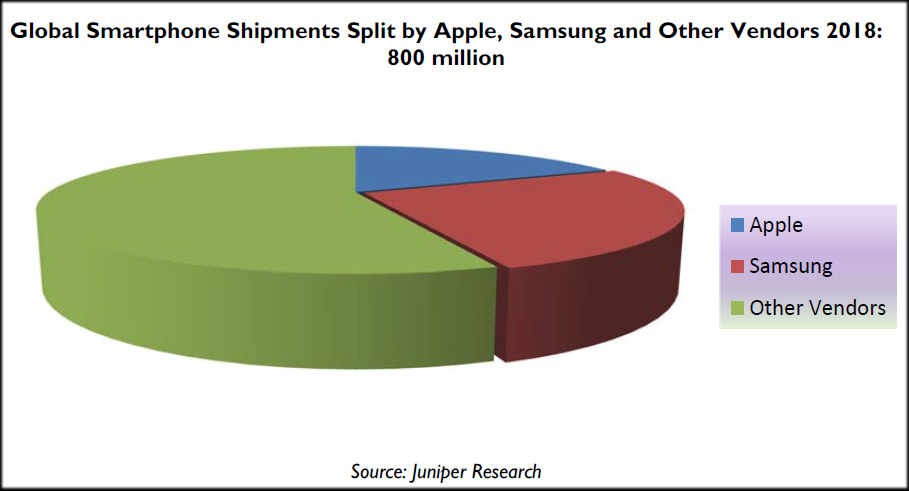

In terms of total global smartphone shipments, Juniper doesn't project anything of surprise - per the report, Apple and Samsung will absolutely continue to dominate the global market. Juniper forecasts that they will ship 17 percent more smartphones in 2018 than were shipped globally by all vendors in 2012. Juniper forecasts that Apple and Samsung’s global smartphone shipments will reach roughly 800 million by the end of 2018, compared with a market total of 677 million in 2012.

Juniper further forecasts sustained growth for Apple in emerging markets over the forecast period. We certainly concur with this. For Apple emerging markets are still green and fertile - there is no iPhone saturation here. In particular, we anticipate that Apple will soon sign a deal with China Mobile that will solidify this viewpoint.

New Regions, New Rules?

The new report specifically notes that significant growth is expected across emerging markets such as the Indian Subcontinent and China. Juniper reports that it believes these areas will see particular growth in what it refers to as the ultra-economy and economy sectors. And the company believes that building devices for these regions utilizing hyper-locality. Slower growth is forecast for the ultra-premium and premium smartphone sectors, but only if they can offer clear differentiation within a crowded market.

Juniper defines its smartphone market segments as follows:

- Ultra-Premium smartphones: $600 and above

- Premium smartphones: $400-$599

- Standard smartphones: $151-$399

- Economy smartphones: $75-$150

- Ultra-Economy smartphones: $74 and below

Even as new mobile operating systems begin to emerge, their impact will hardly be felt immediately. Juniper believes that there will continue to be a very real lack of short and medium term diversity within the OS market. And the report does also go on to suggest what should be obvious - that the average selling price of a smartphone will fall as new lower income demographics are exploited. Yes, it is hardly arguable that this will not be the case.

We ourselves see absolutely no mobile operating system fragmentation occurring. Hence our earlier qualifier. Even if alternative mobile operating systems were to reach as much as 13 percent market share, this is most emphatically not a sign of fragmentation. Our view of it is that this instead makes it crystal clear that there will be no fragmentation. Apple and Android will dominate, and we will no doubt see Windows Phone take some measurable market share from Android over the next five years. Apple, in the meantime, will grow its market share (refer to our China Mobile analysis we noted above for details).

Further, since Apple offers an entirely cohesive ecosystem, we anticipate that iOS 7 will become the single most prolific mobile operating system…period. Android will continue with myriad flavors, with the most recent versions always lagging older versions significantly. Juniper suggests the following general breakdown:

The chart hardly suggests any fragmentation to us. Most of the "other vendor" category will be made up of Android and Windows Phone devices. Rather, the chart suggests a more complete entrenchment for the two giants. Of course we are sidestepping the issue of either or both iOS and Android falling into a complement void of non-innovation. We've already seen this with iOS, though that has been due to the transition from Steve Jobs to Tim Cook - Apple will take care of the innovation question in September. We anticipate ongoing innovation from every mobile OS player.

Juniper's complimentary Smartphones: Ultra-Premium to Ultra-Economy whitepaper is available for download from Juniper's website, along with details of the full report, which is available for purchase.

Edited by

Ryan Sartor

QUICK LINKS

QUICK LINKS