New research from VDC Research shows that even in today's already established BYOD world, the move to create a fully mobilized workforce on a global scale will never the less prove to be chaotic and disruptive to the technology vendor community. The company's annual global study of the mobile device market finds that the market for mobile devices deployed by business and government users will grow to $138.6 billion through an estimated 306.9 million units by 2017, up from $116.2 billion and 220.4 million units shipped last year, in 2012.

But underneath this "happy story of growth" to use VDC's words, the company believes there is a disguised and quite significant degree of underlying turmoil to be found. How so? In particular, the problem is not that the vendors of new technology across smartphones and tablets on the iOS and Android front will find roadblocks, but that these vendors will for the most part prove themselves to become roadblocks to what has long been a staple of the enterprise - Windows-based mobile devices.

VDC finds that Microsoft’s future as the operating system of choice for enterprise-deployed mobile devices in particular notebooks and tablets running versions of Windows 8 is very much in question, with recent missteps causing big problems for enterprises and Microsoft's device partners alike. Both have been sidelined as they wait to see if Microsoft can sort out its mobile OS strategy. The result has been missed sales cycles for device vendors, and increasing frustration for handcuffed enterprises that are unable to evolve their mobile deployments as rapidly as they might have hoped for.

David Krebs, vice president of VDC’s Mobile and Connected Devices Practice, puts it into perspective: “Windows-based product launches have been postponed, as has spending by enterprises, causing real problems for device vendors and enterprises who had previously committed to Microsoft. In the meantime, our research shows that a window of opportunity has been opened for Android and iOS in the enterprise, with interest in both on the rise.”

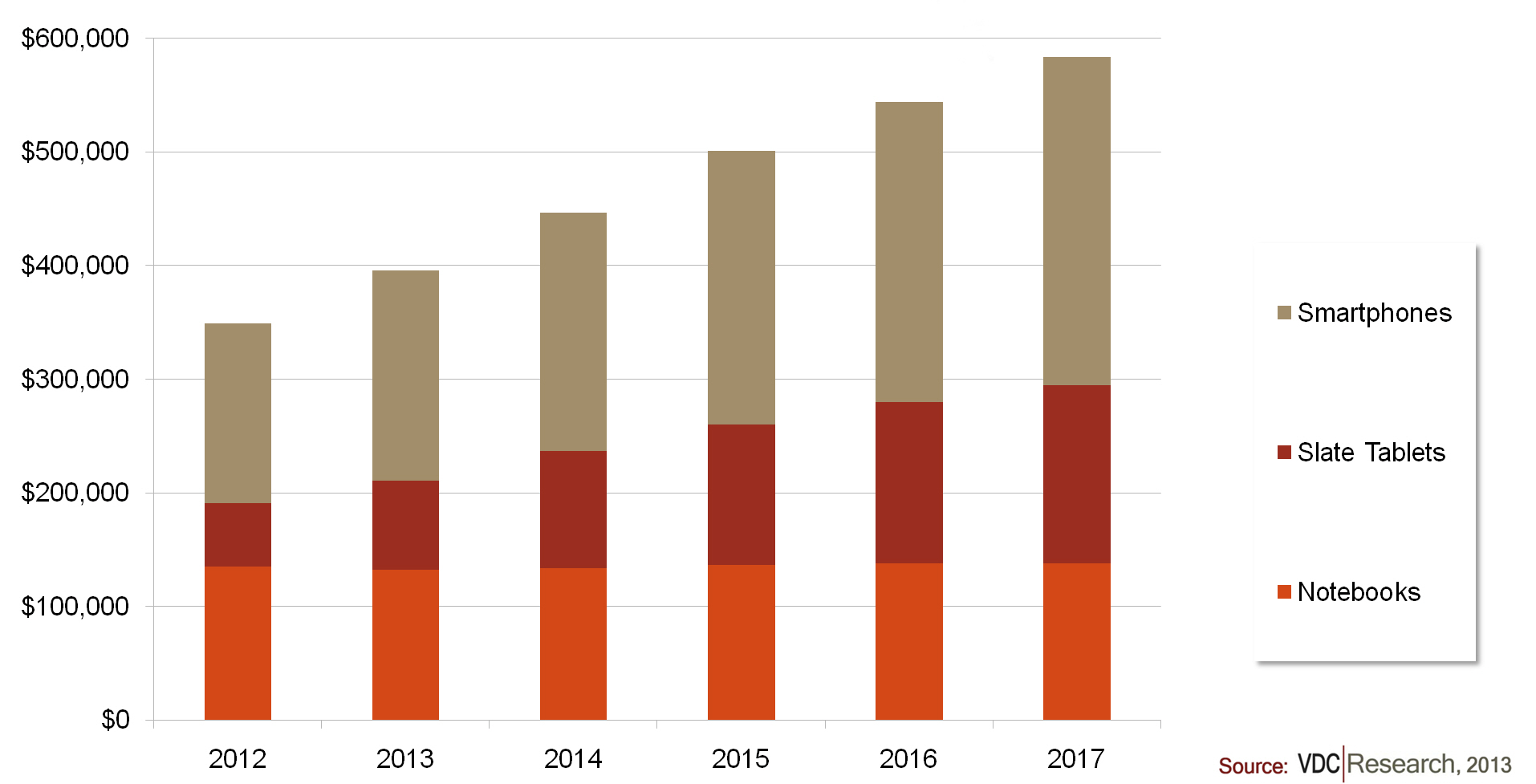

As the chart above suggests, the other big story surrounds hardware evolution. Notebook sales are clearly stagnating as tablets gain traction in many markets. Specifically this once again underscores the issue of Windows-based growth.

VDC's research also points out that the the future of ruggedized, special-purpose devices - which have always tended to be far more expensive than typical hardware, also looks particularly bleak in many markets. It is worth pointing out here that many of these devices actually run Windows Mobile 6.5 and older versions of Microsoft's earlier and now ancient mobile OS. Yes, there are in fact still pockets of these devices - and some manufacturers still make them new, hard as it is to believe.

But the falling prices and the broadening appeal of consumer-grade devices make it increasingly difficult for rugged device vendors to tell a compelling story. In fact, short of very tiny niche markets where specialized hardware may be a health- and compliance-based requirement (oil and gas field work environments for example, where the possibly of a device interacting with certain gases could cause an explosion) we cannot foresee any future whatsoever for these devices. This has further implications for certain manufacturers.

Krebs further notes, “The vendors who once owned the enterprise mobile device market – Panasonic, Dell, and others - have been hit broadside by the move away from notebooks and the challenges with Windows. Big cuts in defense spending have really hurt these vendors too.”

That is is the side of enterprise mobile life that is being disrupted. In its wake however VDC’s research oncovers vast areas of mobile growth - there is no doubt that smartphones and tablets will rule. Note that the chart above shows the market for these mobile devices is huge. In addition, the appetite for enterprise applications will grow through 2017 as well, further fueling device sales growth. The issue is where Windows devices will fit into all of this.

Krebs concludes, “The backstory is really about who will benefit from this growth. Apple and Samsung, of course. But also a myriad of other Android based device vendors who are just starting to crack into the enterprise today.”

Edited by

Rachel Ramsey  QUICK LINKS

QUICK LINKS