Comparing total global shipments of a given category of products – as opposed to comparing specific products, is more often than not a matter of comparing apples and oranges. The latest research from both ABI Research and Juniper Research, for example, notes that Samsung shipped over two times more smartphones in Q3 2012 than Apple did, putting Samsung indisputably in the number one position for smartphone vendors relative to total shipments of smartphones.

Apple comes in behind Samsung at number two, which is quite interesting considering that Apple only sells smartphones at the very high end of the smartphone range.

According to ABI senior analyst Michael Morgan, “Samsung looks to be running away from the pack while Apple’s new product portfolio continues to eat into its decreasing gross margins. Apple will need to ship over 94 million smartphones in Q4 if it wants to match its 2011 shipment growth of 96 percent.”

It is true that Apple is facing a gross margins issue – during its recent fiscal Q4 2012 earnings call the company noted for its fiscal Q1 2013 guidance that its margins would decrease by 4 percent – the sort of number that might cause financial analysts serious concern.

?Total worldwide handset shipments, the ABI report points out, decreased 1.9 percent year over year to 387.3 million units in Q3 2012. Total worldwide smartphone shipments for the same period increased a substantial 32.8 percent year over year to 155.5 million, with Samsung retained the lead position in both handset and smartphone shipments. Juniper Research, in its own report, pegs total worldwide smartphone shipments for Q3 2012 at a slightly more robust 157 million.

Smartphone shipments accounted for 40.2 percent of all handset shipments in Q3 – up from 39.3 percent in the previous quarter.

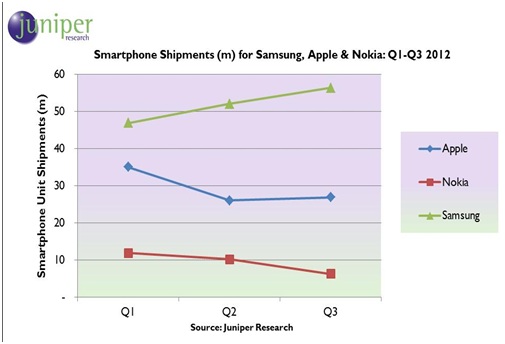

Juniper notes that Samsung accounted for 56.3 million units, while Apple delivered 26.9 iPhones. Juniper also notes that Samsung shipped 18 million Galaxy S III devices – which is in fact the apples to apples comparison that matters relative to the iPhone, and we admit an impressive achievement.

There is no doubt that Samsung is making headway in catching up with Apple on the very high end of the scale. Visually, the numbers look as follows:

As the chart also shows, Nokia smartphone shipments continue to plummet. ABI notes a 38-percent from Q2 2012 to only 6.3 million units shipped. Juniper notes that the decline, compared to Q3 2011, weighs in at a staggering 68 percent. A serious problem Nokia (and Microsoft in a sense) imparted on itself was the move it made to release the Lumia 820 on the Windows Phone 7 platform with a hardware design that cannot support or be upgraded to Windows Phone 8. Talk about shooting one’s self in the foot! And of course, Nokia then announced – though it as yet has not released – the WP8-based Lumia 920, though that may finally change on Monday, October 29, 2012.

Both ABI and Juniper note that LG managed to return to profitability, primarily on the strength of the company’s strong LTE smartphone growth. LG posted 24 percent quarter over quarter growth, shipping 7 million smartphones during the period – a record for the company.

The company looks well positioned to maintain strong positioning among the second-tier smartphone players.

China’s ZTE also looks to be gaining ground – albeit it not at the high end, with a very strong shipment growth rate of 168.4 percent according to the ABI report. Juniper claims that ZTE shipped almost 20 million smartphones over the first three quarters of 2012, with third quarter sales exceeding both Nokia and Research in Motion (RIM).

What about RIM? As it has done for the last several years, the company continues to struggle; in its most recently reported quarter, the company shipped all of 7.7 million BlackBerry devices. Whether or not RIM will ever be able to turn itself around rests entirely on the anticipated early Q1 2013 launch of the company’s new Blackberry 10 OS, and on RIM’s ability to deliver truly exciting new devices.

The odds for survival are slim at best, though we continue to root for the company to deliver a winning strategy.

Samsung’s strategy of offering an expanding line of both high- and low-end smartphones continues to pay dividends for the company in terms of overall growth. This very strategy was once Nokia’s own powerful strength, but while Nokia kept trying to feed the world feature phones, Samsung made the move to the 21st century, and the rest, as they say, is history.

Apple will never win the battle relative to “total smartphones sold” but then, it isn’t even a game Apple tries to play.

Apple’s goal is to simply provide enough phones at just a few different price points to ensure that anyone who wants an iPhone can afford to get one. It is a second place strategy as far as total phones sold, but it’s the first place strategy as far as owning the smartphone at the very top of the heap.

That leaves us with the issue of Apple vs. Samsung, as we head full bore into the holiday buying season. This is where Apple always swamps the competition, and with all of the new products the company now has in play following this week’s announcements, which now also includes the iPad mini, we expect things to follow their usual course.

The question that still hangs in the air concerning Apple is whether or not it will be able to meet iPhone 5 demand – something that continues to be an issue six weeks beyond its arrival.

Edited by

Braden Becker  QUICK LINKS

QUICK LINKS