With the competition for next generation networks running at a powerful pace - with both Verizon breathing down its neck and Sprint soon to flex its own new financial muscle through its Softbank merger, AT&T has opted to step up the pace of the race. Today, during an analyst webcast, the company announced new plans to invest $14 billion over the next three years to significantly expand and enhance both its wireless and wireline IP broadband networks. Faced with growing customer demand for high-speed Internet access and new mobile, app and cloud services (all of this is a good thing), AT&T had to make such a move in order to not only maintain growth, but to ensure it remains highly competitive.

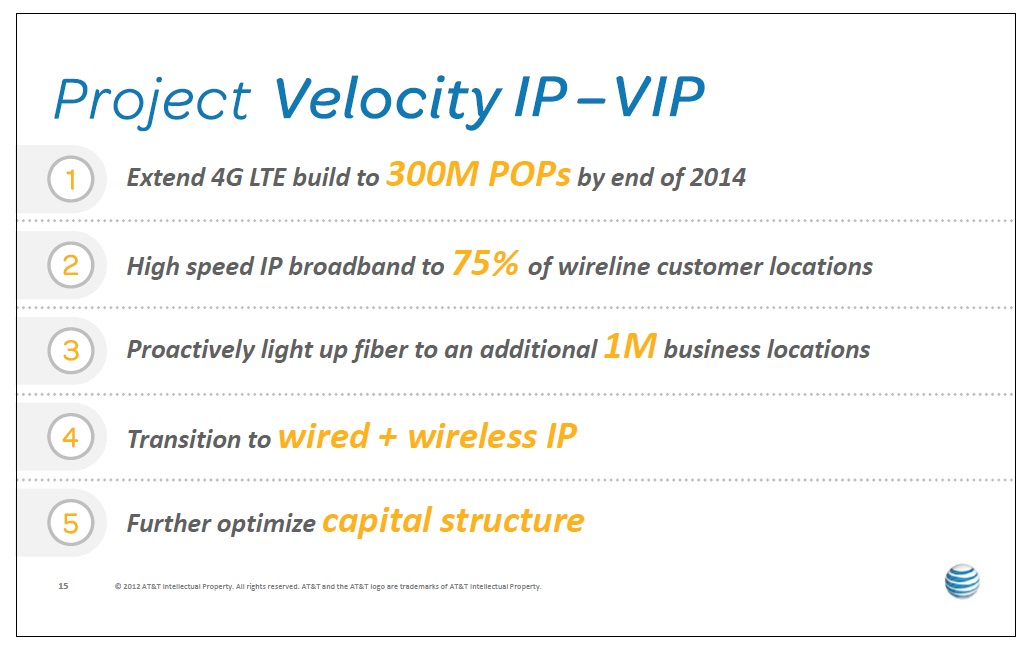

The investment plan, which AT&T refers to as "Project Velocity IP" (VIP), will expand AT&T’s high-potential growth platforms. The primary goal of course is to drive both short and long term continued increases in revenue from existing and new products and services, and in turn driving up earnings per share. VIP also really represents AT&T's answer to moving forward - finally - following its loss in acquiring T-Mobile (a loss we ourselves continue to lament).

The $14 billion investment will break out to $8 billion for wireless initiatives and $6 billion for wireline initiatives. Total capital spending is now expected to run at approximately $22 billion for each of next three years. The plan is, when viewed from 20,000 feet, ambitious. The following slide from this morning's presentation provides an overview of Project VIP:

At ground level however, it is something that AT&T has no way of avoiding - it needs to make the investments and needs to ensure that it remains highly focused in doing so within the three year timeframe it has set for itself. The slide above shows the outline, but what are the necessary details? AT&T’s Project VIP consists of several individual wireless and wireline initiatives, which are outlined below. John Stankey, AT&T Group president and Chief Strategy Officer handled most of the wireless infrastructure presentation at the event, and provided the details we note below.

Mobile Internet Growth

First, the company is investing significantly in mobile Internet growth, with the following strategies:

- 4G LTE Expansion: AT&T will seek to expand its 4G LTE network to cover 300 million people in the United States by the end of 2014. This increases what AT&T had already planned here, and represents adding 50 million subscribers in addition to its current plans to deploy 4G LTE to about 250 million people by the end of 2013. In AT&T’s 22-state wireline service area, the company expects its 4G LTE network will cover 99 percent of all customer locations.

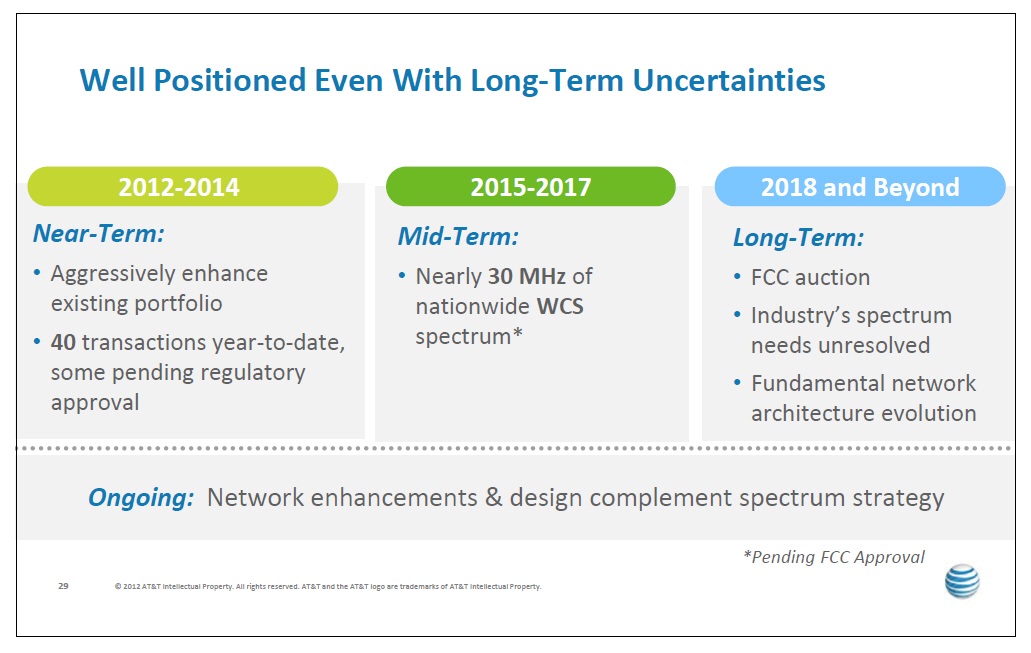

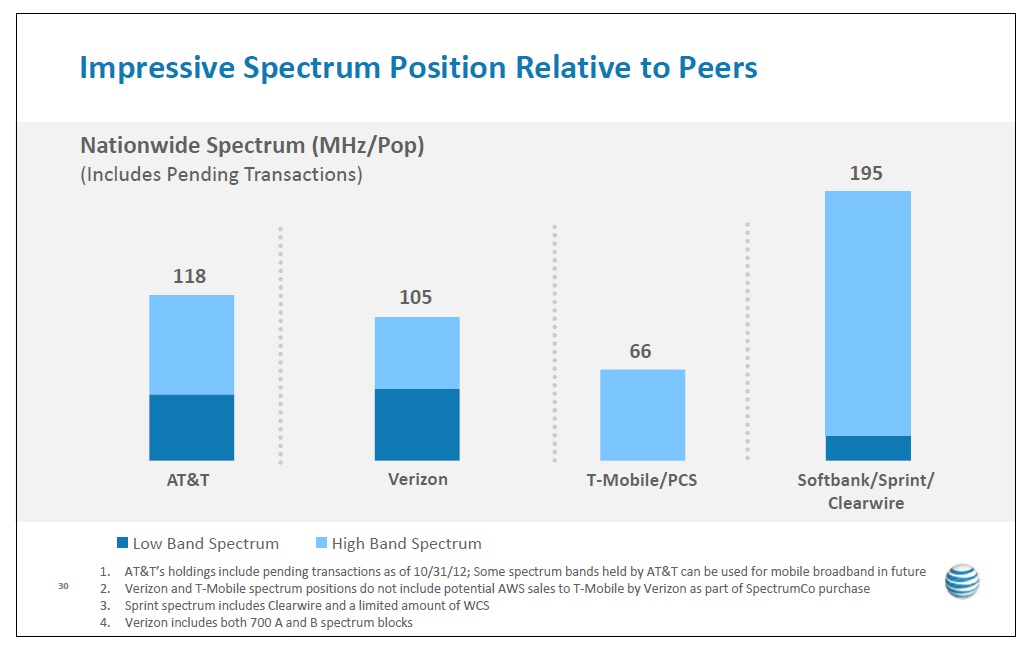

- Spectrum: AT&T has acquired spectrum through more than 40 spectrum deals this year (some of which are still pending based on regulatory review) and plans to buy additional wireless spectrum to support its 4G LTE network. Much of the additional spectrum came from an innovative solution in which AT&T gained FCC approval to use WCS spectrum for mobile broadband - we've covered this solution previously, and it is critical to AT&T's plans here. Between what the company already owns and transactions pending regulatory approval, AT&T expects to have about 118 MHz of spectrum nationwide. AT&T will (of course) continue to advocate with the FCC for release of additional spectrum for the industry’s long-term needs.

- Densification and Small Cell Technology: We admit we like the use of the new word "densification." As part of Project VIP, AT&T expects to deploy small cell technology, macro cells and additional distributed antenna systems to increase the density of its wireless network, which is expected to further improve network quality and increase spectrum efficiency. This "micro" technology is critical, and something that we scoped out previously in an article questioning whether or not we are spectrum rich or spectrum dumb.

The following slide summarizes AT&T's strategic and tactical positioning:

The next slide provides some very interesting spectrum capabilities amongst AT&T and its competitors:

Wireline IP Network Growth

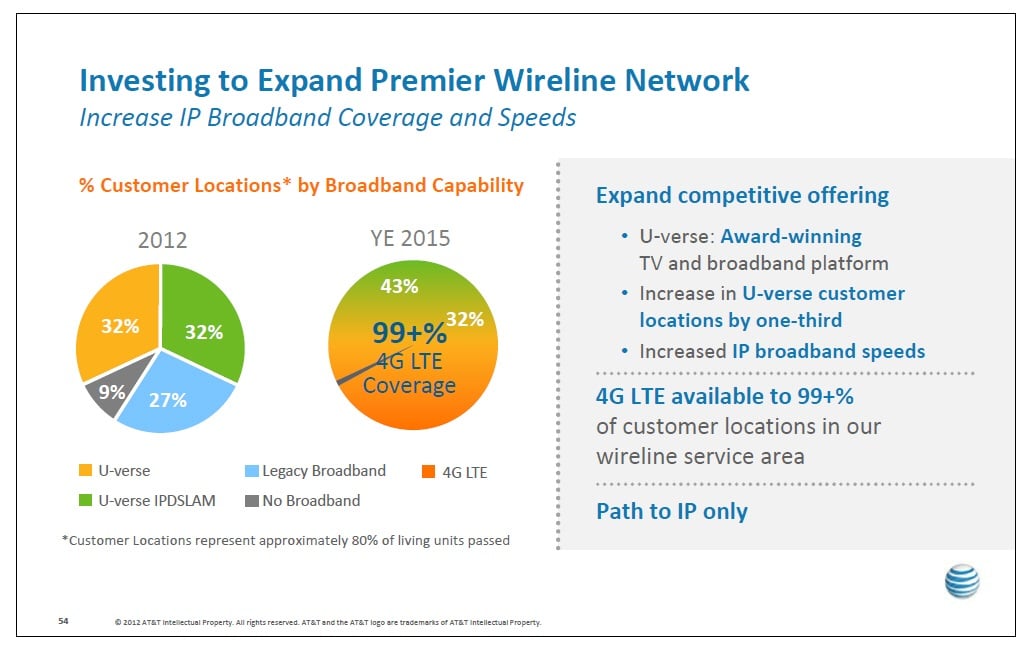

As much as mobile growth and mobile Web access is critical to AT&T, a major component of its growth strategy also consists of vastly improving wireline growth. On this front, AT&T will look to expand and significantly enhance its wireline IP network to reach 57 million consumer and small business locations or 75 percent of all customer locations in its wireline service area by year-end 2015. This network expansion, as detailed by John Donovan, Sr. Exec. VP, AT&T Technology & Network Operations, will consist of the following:

U-verse: No surprises here - AT&T plans to expand U-verse (its version of the "three play" - TV, Internet, Voice over IP telephone services) by more than 33 percent or roughly 8.5 million additional customer locations. This will bring the total potential U-verse market to 33 million customer locations. The expansion is expected to be essentially complete by year-end 2015. We should note here that AT&T specifically means that it will have the ability to service 33 million locations - this doesn't reflect the actual U-verse population, but rather the potential number of locations to convert into customers (Verizon provides the same exact numbers for its FiOS capabilities).

- U-verse IPDSLAM: The company intends to offer U-verse IPDSLAM service (high-speed IP Internet access and VoIP) to 24 million customer locations in its wireline service area by year-end 2013.

- Speed Upgrades: The AT&T plan includes an upgrade for U-verse to speeds of up to 75 Mbps and for U-verse IPDSLAM to speeds of up to 45 Mbps, with a path to deliver even higher speeds in the future.

- Back to Wireless and LTE: In the 25 percent of AT&T’s wireline customer locations where it’s currently not economically feasible to build a competitive IP wireline network, AT&T will utilize its LTE wireless network - where and as it becomes available - to offer voice and high-speed IP Internet services. The LTE network will cover 99 percent of all in-region customer locations. In many places, the LTE service will be the first high speed IP broadband service available to many customers.

- Fiber to Multi-Tenant Business Buildings: AT&T will look to expand its fiber network to reach an additional one million business customer locations – 50 percent of the multi-tenant business buildings in its wireline service area. AT&T expects that proactive fiber deployment will increase business revenue growth, accelerate provisioning and facilitate the installation of distributed antennas systems and small cell technology to help offload wireless network traffic.

The following slide shows a summary of U-verse, IP and LTE expansion:

The following slide depicts the 20,000 foot view of the overall network that will result from the announced investment plan:

New Growth Initiatives

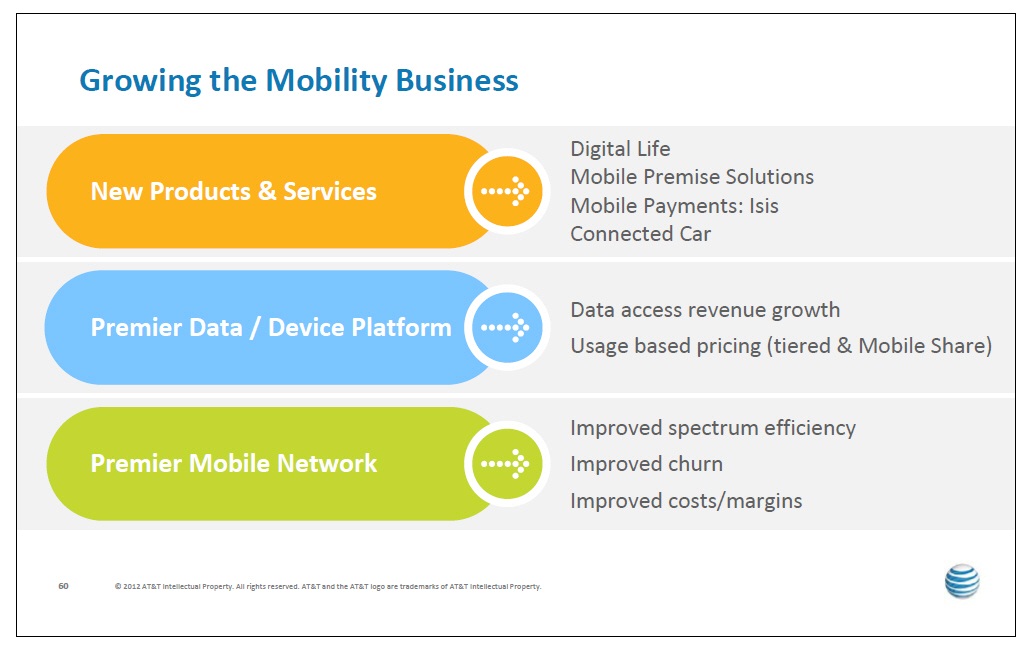

Finally, the ever present Ralph de la Vega, president & CEO for Mobility, provided insights into expanding AT&T’s LTE network to 300 million people, combined with smartphone deployments and data access to provide a large platform for the next wave of growth in mobility. These plans include the following:

- AT&T Digital Life: A nationwide all IP-based home security and automation service set to launch in 2013 that will let consumers manage their home from virtually any device - smartphone, tablet or PC.

- Mobile Premise Solutions: A new nationwide service that is available today, this is an alternative for wireline voice service that in the future will also include high-speed IP Internet data services.

- Mobile Wallet: As is already well-known, AT&T is a participant in the ISIS mobile wallet joint venture. Market trials are currently underway in Austin, TX and Salt Lake City, UT.

- Connected Car: Well, it certainly would not be the future without a mention of the connected car and de la Vega did not disappoint us on this front. More than half of new vehicles are expected to be wirelessly connected by 2016 and AT&T believes it is positioned to expand capabilities from vehicle diagnostics and real time traffic updates to consumer-facing applications that tie into retail wireless subscriber data plans. AT&T already has deals with leading manufacturers such as Ford, Nissan and BMW.

Here is a visual summary from de la Vega's presentation:

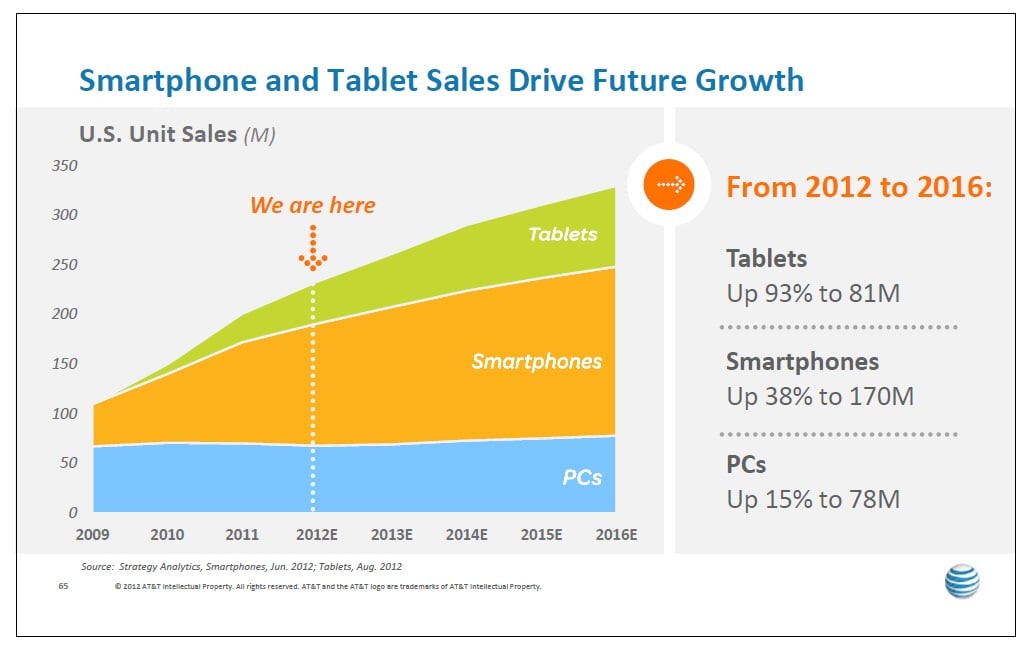

Finally, here is a slide that shows how devices will play out in in de la Vega's mobile world over the next 4 years or so:

All in all it is an ambitious plan, as we noted earlier.

“This is a major commitment to invest in 21st Century communications infrastructure for the United States and bring high-speed Internet connectivity - 4G LTE mobile and wireline IP broadband - to millions more Americans,” notes Randall Stephenson, AT&T chairman and chief executive officer. "We have the opportunity to improve AT&T’s revenue growth and cost structure for years to come, and create substantial value for shareowners."

“Revenue in our key growth areas — wireless data, U-verse and strategic business services — are all growing at a strong double-digit rate. Project VIP expands our potential in these key platforms and makes them available to many more customers,” Stephenson continues. “With our strong balance sheet, these capital investments are manageable. We are very confident in our ability to execute this plan. These are things we’ve done before – logical extensions of proven technologies and already successful businesses.

We wish ATT&T good luck in executing on all of this. Our mobile world demands that AT&T does so.

Edited by

Brooke Neuman

QUICK LINKS

QUICK LINKS