Consultancy and research company Analysys Mason, which specializes in telecom, media and technology, has an interesting perspective on the LTE market – which it rightly acknowledges is thriving in the United States while languishing in other global regions. There are many reasons for this – some of it having to do with economics and the need for global telcos in certain world regions to cut back on CapEx. In others, such as in the UK, there are underlying politics at play.

Analysis Mason has another angle worth exploring – that the US carriers are simply being much smarter about their LTE deployments. The research firm claims that the US telcos are doing so by focusing on both coverage and a multi-device strategy. Most telcos outside of the United States believe that LTE represents an opportunity for operators to increase revenue by simply pricing the new service at a premium. Mason strongly suggests that taking this viewpoint is a mistake.

The company believes that the LTE operators in the USA are not following the premium pricing model strategy, but are instead successfully building continued traffic growth and driving additional usage through a multiple device strategy tied to LTE network growth and coverage. Mason believes this approach is encouraging users toward more expensive data plans, which is resulting in consistently increasing ARPU. US operators are attracting subscribers to their LTE networks by rapidly building out their networks and by not charging a premium for the service.

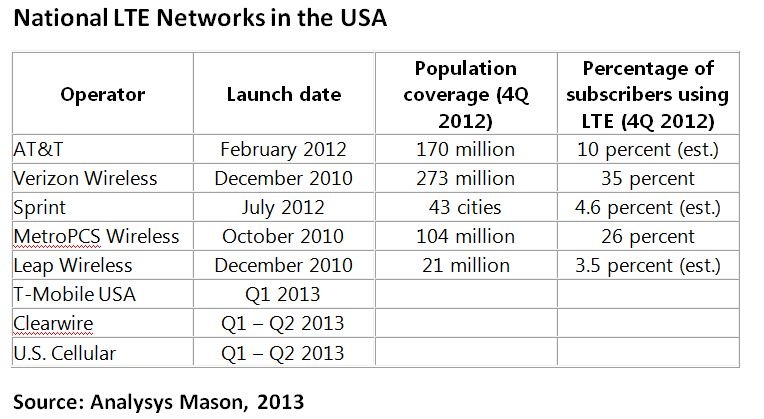

The US has the most competitive 4G/LTE market in the world, with five operational LTE networks as of December 2012, as shown in the table below. These span multiple business models including low-cost, prepaid and high-speed premium services. MetroPCS Wireless (now merging with T-Mobile) and Verizon Wireless launched LTE services during the fourth quarter of 2010, both moving from CDMA-based 3G networks that were increasingly uncompetitive against AT&T and T-Mobile’s HSPA+ networks and the WiMAX network operated by Sprint partner Clearwire. LTE, HSPA+ and WiMAX are all marketed as 4G services in the USA by their respective operators.

Verizon launched its LTE network in December 2010, ahead of an original expected 2011 start, catching the competition off-guard. AT&T of course spent most of 2011 trying to buy T-Mobile for both its compatible spectrum and key cell sites in major US cities – ultimately a costly failure. Sprint, meanwhile, needed to revamp its network architecture to support its many technologies and decide on a long-term strategy for partner Clearwire and its 2.5 GHz WiMAX network.

Verizon Wireless’ aggressive strategy to quickly build out its LTE network resulted in national first-to-market leadership and as much as 89 percent coverage of the USA population by December 2012. The Verizon Wireless strategy ultimately forced AT&T Wireless’ own hand, and the company had to scramble to accelerate its own network build, aiming to reach 55 percent coverage in less than one year. In turn, the two finally drove both Sprint and T-Mobile to announce their own LTE plans last year. By 2012, consumers had a number of viable choices available in terms of LTE services – some of which provided the extra incentive of fully unlimited and un-throttled wireless data access plans.

The impact on the market of this competitive activity was the marketing focus on network coverage in addition to speed, which put smaller operators Leap Wireless and MetroPCS at a significant disadvantage. MetroPCS is now in the process of merging with T-Mobile, and Leap Wireless is actively seeking partners to utilize the company’s unused spectrum and share the cost of further network build out. And Sprint has agreed to sell most of itself to Softbank to gain access to the necessary dollars to continue its own LTE build outs.

These US operators initially marketed LTE by highlighting its speed benefits, and kept the same pricing plans as 3G services in order to entice users onto the new networks, including customers on flat-rate plans. LTE was not pushed as a premium alternate service, but was presented as the natural progression of upgrades users are entitled to.

AT&T and Verizon have both shifted their pricing strategies in order to increase revenue. Initially, both operators largely eliminated flat-rate pricing plans in favor of tiered pricing, and in 2012 both operators implemented a multi-device, tiered data package pricing strategy. Operators are still adopting the strategy of “no premium for LTE,” with the only difference between a 3G subscription plan and an LTE plan being the device used.

Instead of charging more for the LTE service, operators want to connect additional devices for a nominal fee (usually $10 to $30) to encourage users to switch to larger data plans. The main point Mason makes is that this strategy clearly appears to be working: 25 percent of AT&T Wireless users and 23 percent of Verizon Wireless users have signed up for their respective multi-device plans, and AT&T reports that over 25 percent of its multi-device users are opting for 10 GB or higher plans as of December 2012.

Worldwide LTE operators can learn from the competitive success of the US operators’ aggressive national build-out plans and evolving pricing strategies focused on multi-device usage and the role that devices play in the take-up of LTE.

Analysys Mason’s forthcoming “Viewpoint, LTE Lessons from Market Leaders in the USA” will provide additional insights.

Edited by

Brooke Neuman  QUICK LINKS

QUICK LINKS