The world has finally reached a momentous occasion - the auction of coveted 4G spectrum is now finally underway in the United Kingdom – the only European country still without any LTE capabilities. It clearly represents a critical juncture for the country’s wireless market – which has lagged significantly and over several years on the 4G front, with the winners set to gain access to data bandwidth essential for meeting the endless demand for mobile and wireless data services. The UK government will likely see £3.5 billion ($5.5 billion) generated from the auction.

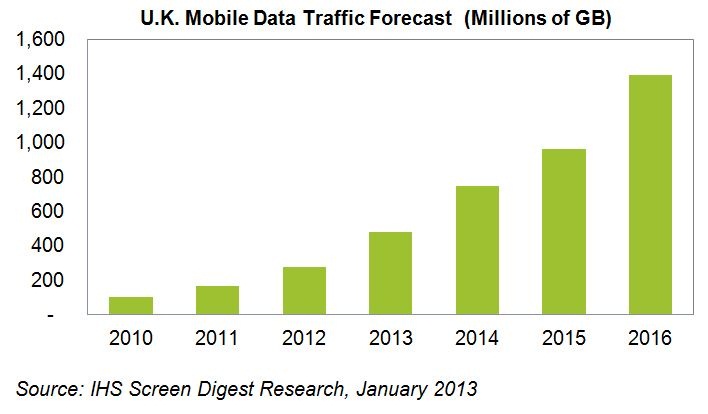

According to a new report from information and analytics provider IHS, U.K. mobile data traffic will rise by more than 400 percent from 2012 to 2016, driven chiefly by heavily increased smartphone use. IHS forecasts mobile data traffic in the country will rise to 1.4 billion GB in 2016, up from 274 million GB in 2012, as presented in the chart below.

As is the case in most developed regional markets, the UK has seen massive growth in smartphone users over the last half decade. In addition, there has been a strong adoption of large screen mobile broadband services. Combined, the demand now being generated is driving a substantial increase in data traffic carried by the mobile operators, along with significant strain in meeting the demand. LTE is clearly needed to ensure that the wireless support will be there for mobile users.

The Spectrum Band Matters – a Great Deal

The auction features 2.6 GHz spectrum best suited for urban deployments and scarce spectrum at the 800 MHz band, which is especially suitable for delivering wireless services in rural areas. Why? Because the longer wavelengths associated with transmissions at the 800 MHz band allows signals to travel further, which in turn results in geographically larger cells. Larger cells mean that fewer cell site deployments are required within any given rural range, which for operators translates directly into lower deployment costs and more efficient rural area coverage.

IHS notes that 800 M Hz cells typically result in approximately 10.5 times larger cells than can be had at the 2.6 GHz band while transmitting with the same levels of power. In short, this means that the 800 MHz spectrum is much more valuable than the 2.6 GHz band for covering large areas. The flip side of this is that the 2.6 GHz band is more suitable for congested urban areas.

The four existing players that have entered the auction are EE, O2, Vodafone and Three. There are, in addition, three new entrants - BT, PCCW and MLL Telecom. Other European spectrum auctions have typically resulted in a maximum of three wireless operators winning 800 MHz spectrum. It is likely, though not guaranteed, that the UK will follow in step, with three ultimate winners and four losers.

Daniel Gleeson, mobile analyst at HIS notes that, “The importance of this spectrum auction in shaping the future of the U.K. wireless market cannot be understated. Access to spectrum is the main barrier to entry for any company looking to build a new wireless network. The amount a company spends in the auction will affect their business performance for years to come. With only three companies likely to win spectrum, at least one of the United Kingdom’s existing operators is likely to lose out. It is a big deal. The winners will have the bandwidth required to keep pace with the boom in mobile data—while the losers will struggle to remain competitive in the mobile market.”

IHS claims in its report that of the existing mobile operators, those with the most to lose are O2 and Vodafone, neither of which currently owns 4G spectrum. Not securing 800MHz licenses would, Gleeson continues, “be a disaster for O2 or Vodafone as their current licenses do not allow for the deployment of 4G, while relying on the 2.6 GHz spectrum would severely limit their capability to cover most of the country.”

While the deployment of 4G services will be the primary outcome from the auction, spectrum auctions have a habit of rearranging all the deck-chairs in the mobile market in any particular country. The past few years have certainly seen plenty of cooperation between competitive operators, especially in site-sharing deals, which reduce costs while simultaneously expanding potential coverage for both partners.

How the current crop of auction players is likely to re-arrange itself relative to winning or losing on the auction will change the current dynamics of the playing field. It is certainly well worth keeping an eye on. Details on obtaining the full report are available at the IHS Screen Digest Mobile Technology Intelligence Service website.

Edited by

Brooke Neuman  QUICK LINKS

QUICK LINKS