Wireless carrier revenue from 4G Long Term Evolution (LTE) will reach just over $75 billion in 2013. That is a hefty number of dollars, and strongly suggests that there is good reason for wireless carriers to move quickly to build out LTE networks. There is gold in those hills, so to speak. But that $75 billion is just the tip of the iceberg.

According to a new just released report from Juniper Research titled, “4G LTE Strategies: Subscribers, Devices, Infrastructure & Service Revenue 2013-2017” mobile network operators (MNO) can anticipate that 4G LTE revenues will grow well beyond $75 billion. In fact, the report predicts that global revenue from LTE services will top $340 billion by 2017. As large as that number is projected to be, Juniper notes that it will still only represent about 31 percent of total global wireless service revenues from all mobile services sources, which include old 2G and 3G networks (which will still be workhorses in 2017). Keep in mind that emerging machine to machine (M2M) applications more often than not need nothing more than 2G capabilities to communicate – so 2G isn’t quite ready to give up the ghost.

There are two key issues with LTE deployments – timing of availability and the cost of the spectrum – which play pivotal roles in deciding the speed of LTE rollouts (as has happened in the U.S. and the U.K.). There is no doubt that 4G LTE can represent a substantial investment; in some cases carriers have had to step back from larger scale deployments that will take several years to recoup. With a $340 billion market at stake however, MNOs cannot avoid LTE – they can only do so at the risk of becoming bit players.

That growth to 31 percent of all wireless revenue however, clearly points to the ongoing success of LTE, especially in well established markets that are able to support higher value subscribers. The report finds that with LTE gaining momentum over the past 12 months those high value subscribers, which have more often than not come from the enterprise market, will begin to move rapidly to consumer subscribers. The report anticipates that consumer-based subscriber volumes will overtake enterprise subscribers in 2015.

4G LTE Pricing Strategies are Critical

The Juniper report also uncovered a strong need for the MNOs to develop clear pricing strategies to transition customers. For example, with spectrum auctions underway in the U.K., EE felt obliged to cut down its initial LTE pricing by approximately 14 percent within weeks of its network launch while Three UK has already announced 4G access at no extra cost

Nitin Bhas, who authored the report commented, “Overall MNOs will have to present customers with innovative services that will meet users’ requirements and, crucially, that users will attach value to. Operators will have to review their tariff structures to balance the need to monetize the greatly increased data throughput, yet still offer attractive packages.” We’ve noted the need for MNOs to set clear pricing and services strategies elsewhere as well. It is a key factor for MNOs to achieve success.

The report also finds the following:

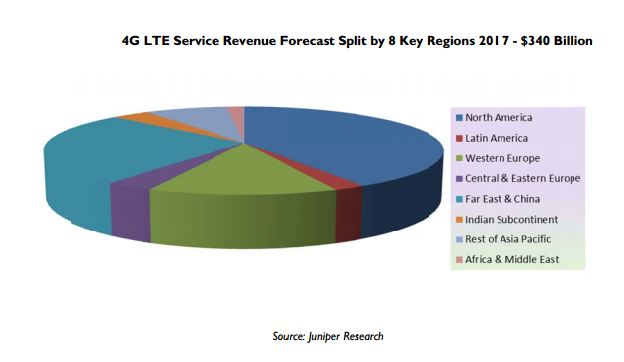

· The vast majority of LTE revenues, roughly 70 percent, will be generated by the North American and Far Eastern and China markets.

· While LTE consumer subscribers will exceed enterprise subscribers in 2015, the consumer segment will only account for under half of all total revenues.

Country by country distribution is projected to look as shown in the chart below.

A white paper based on the full report,

4G LTE ~ Fast & Furious, is available as a free download from the Juniper website. The full report is available for purchase as well.

Edited by

Jamie Epstein

QUICK LINKS

QUICK LINKS