In February, Oracle bought up Acme Packet. A mere 12 days ago it picked up Nimbula, a startup specializing in private cloud infrastructure management software. And as the tech and communications world now mostly knows, Oracle has done it again, swooping in to buy up Tekelec - a company that only a short time ago had decided to take itself private.

Tekelec has delivered a number of communications solutions over the years, but most recently it has been known more specifically for communications platform capabilities that handle network signaling, policy control, and subscriber data management solutions for communications networks. As it turns out, Oracle believes these services are becoming of vital importance, and it sees Tekelec as the smart way to own a reputable solution here. It's not exactly a strategy that’s hard to argue against.

Oracle's view of the communications market is that it is entering a new phase of rapid growth, and it clearly has targeted the space as a means for Oracle itself to develop what it hopes will be significantly enhanced global revenue opportunities. We look at it as a strategic reach - by no means is Tekelec a tactical piece of tuck-in technology.

Rather, it adds a core technology solution to what Oracle clearly believes it needs to deliver on in order to offer a complete, one-stop communications solution for today's communications market.

The proliferation of smart devices, mobile applications and connected services has led to an exponential increase in network signaling and data traffic. Service providers now have a major need for intelligent network control technologies to address ever increasing network workloads.

Perhaps more important, the communications players also need significant help in both deploying and monetiziing cloud and over-the-top services.

Tekelec and Oracle Fit Together Very Nicely

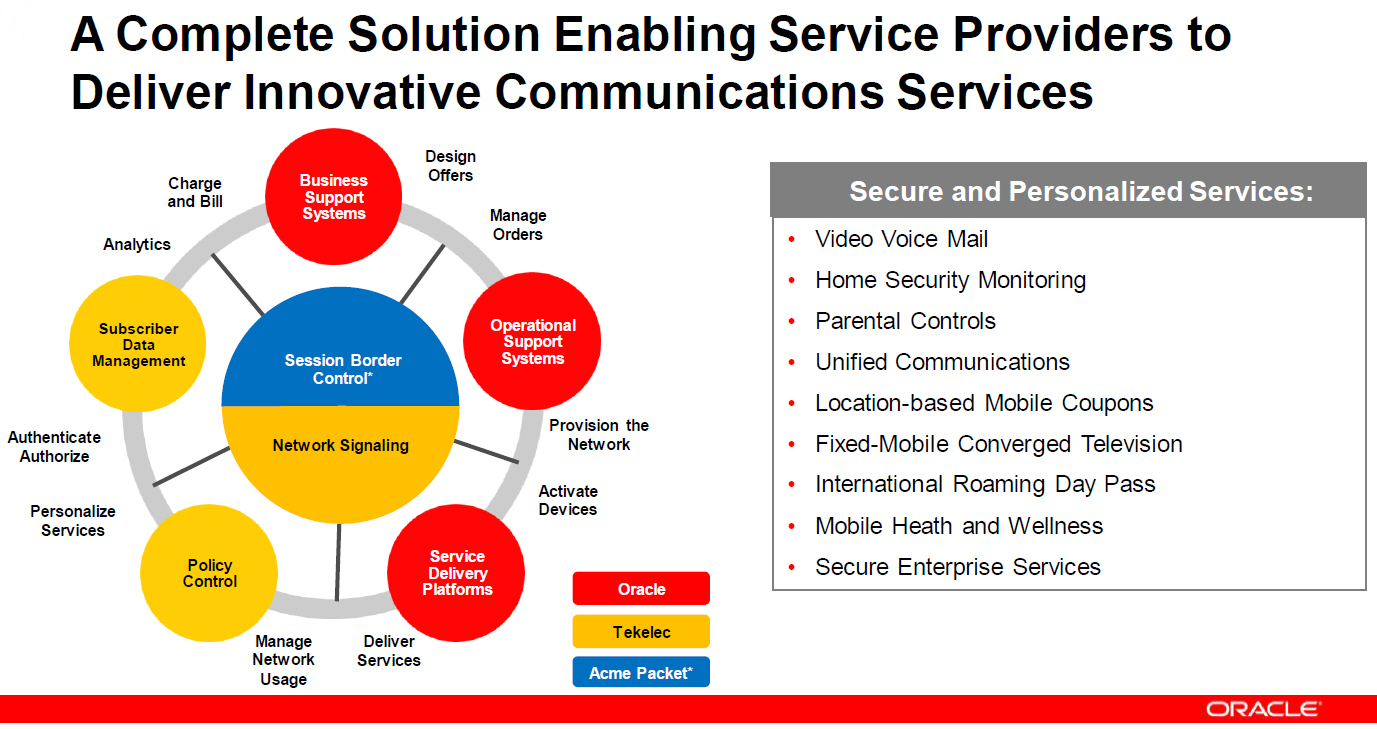

Tekelec’s solutions allow communications vendors to deliver, control and monetize "personalized" communications services. Tekelec’s network signaling, policy control and subscriber data management solutions complement Oracle Communications’ mission-critical operational support systems, service delivery platforms, and business support systems - and are expected to help service providers efficiently allocate and monetize network resources.

The acquisition will allow Oracle to deliver quickly on this.

Ron de Lange, president and CEO at Tekelec, agrees with our assessment; “In an increasingly mobile and social world, customer experience is about optimizing network performance and personalizing services based on what engages, moves, and inspires people. Together with Oracle, we expect to accelerate the pace of service innovation by helping service providers transform the way they manage and monetize the explosive growth in signaling and data traffic on their networks.”

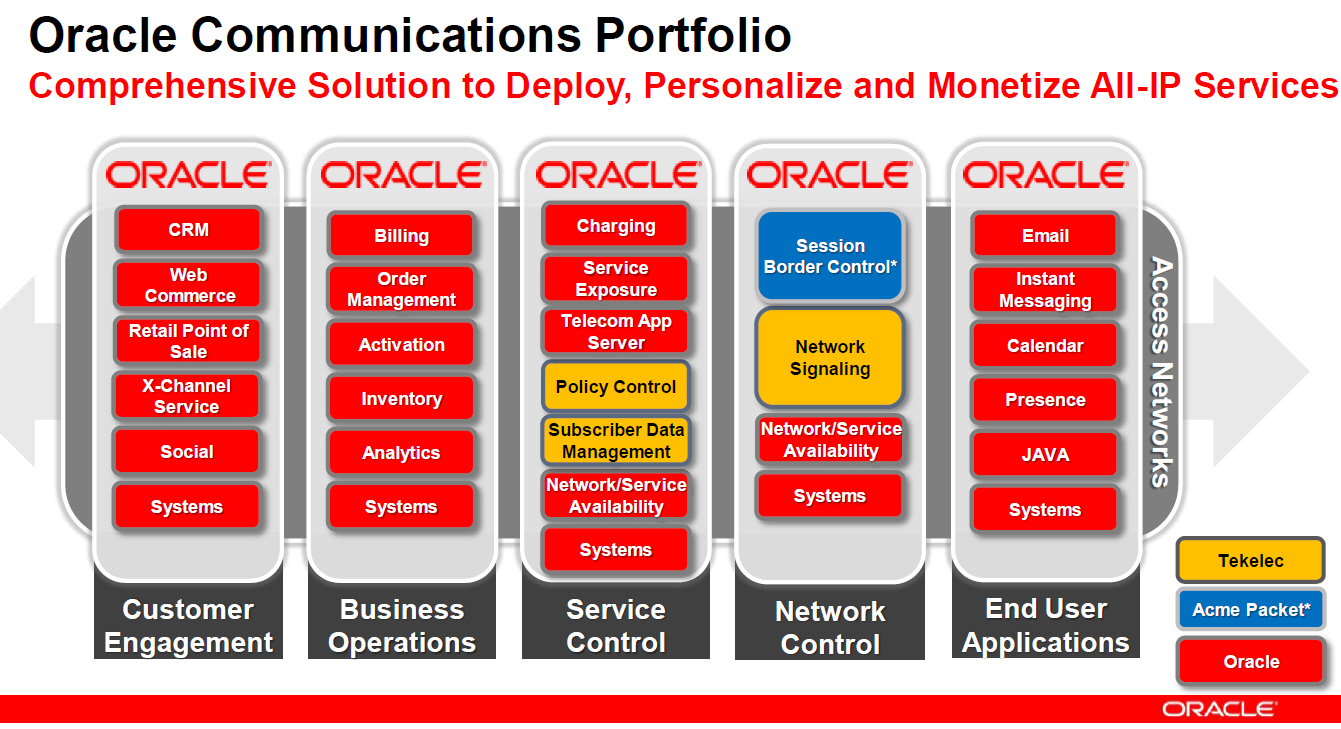

A picture here is worth well more than a 1,000 words, so let's take a look at what Oracle's entire platform consists of, and note specifically where both Acme and Tekelec fit into the puzzle.

As we mentioned earlier, this clearly isn't simply a minor technology tuck-in buy (nor was Acme). We can define the three key solutions Tekelec brings to the game for Oracle as follows:

- Network Signaling: Acts as the network’s nervous system; allows service providers to manage network signaling traffic. Tekelec's Diameter/SS7 solution provides a flexible, scalable signaling solution that covers 2G, 3G, and 4G LTE networks. Integrated applications include local number portability, equipment identity register, 3G to Voice over LTE (VoLTE) migration, load balancing, congestion control, and protocol mediation. Finally, the platform also provides easy interconnection to roaming partners and over-the-top application providers.

- Policy Control: Acts as the network’s brain; allows service providers to apply business rules governing how network resources are allocated and services are defined. Also scalable and flexible, Tekelec's solution allows its customers to define policies, and apply them across an entire network- from the network core out to the edge where mobile devices and over-the-top applications sit. Customers can easily create, launch and monetize communications services, including application and content-based service tiers.

- Subscriber Data Management: Acts as the network’s memory; allows service providers to personalize the experience based on user characteristics. Tekelec's solution delivers dynamic subscriber data for policy control and routing signaling traffic. This is the piece of technology that allows carriers to deliver personalized services specifically based on subscriber data. Customers are able to deliver a consistent user experience regardless of network device, application and location - this is a key customer experience issue. Finally, this component is responsible for safeguarding the security and privacy of subscriber data.

Where do we think Oracle truly sees the value in the partnership? The technology of and by itself is impressive, but that would not be enough for Oracle - keep in mind that we are speaking here about Oracle seizing the moment to create a new strategic revenue stream for itself. To this critical end, Tekelec's three-solution sets brings the following to Oracle's game:

- Network Signaling: Over 300 customers in over 100 countries.

- Policy Control: 60 customers - including 51 Tier 1 service providers.

- Subscriber Data Management: 46 customers across 33 countries.

What's not to like - or rather love - about this deal? For Oracle the numbers shown in the second set of bullets above are just as critical to it as the solutions themselves.

The graphic below shows how the Oracle platform puzzle ends up coming together when the Oracle, Tekelec and Acme pieces are all integrated into a whole platform. Kudos to Oracle for completing the puzzle. The technology side is now complete - or rather it will be once both the Tekelec and Acme deals formally close. All that remains is for the sales teams to kick into high gear and start pulling in the new revenue.

Ultimately how much the communications business adds to its top line as a result of these Oracle purchases will be the report card that counts. It will be a number of quarters before we’ll know the grade, but a B+ and likely higher is in the cards.

Edited by

Braden Becker

QUICK LINKS

QUICK LINKS