Back in early January 2013, we made note of what we’ve referred to as the obvious – the PC industry is now in decline. It’s real. Live with it. The real question, however, is what “decline” really means.

In a market that is for the most part saturated, and in a market where technology is already so good that there’s little need to upgrade as one might have done back when the PC industry was still in its Wild West days, is it fair to say that PC sales are imploding? Back then, every new next-generation PC brought with it significant improvements in performance.

These days, there isn’t even marginal incremental value in most people upgrading, relative to what they use their PCs for. PCs are far beyond “good enough” for the vast majority of users.

In fact, the one way to improve what one already uses is to make it more mobile, more transportable and more convenient. When Steve Jobs said we’re moving into the next era of computing, he was absolutely right – the tablet is here to stay. In fact, a brand new ABI Research report projects that tablet sales in 2013 will reach $64 billion. This is all a natural evolution.

The PC industry isn’t in a state of decline; it is evolving into a state of natural equilibrium.

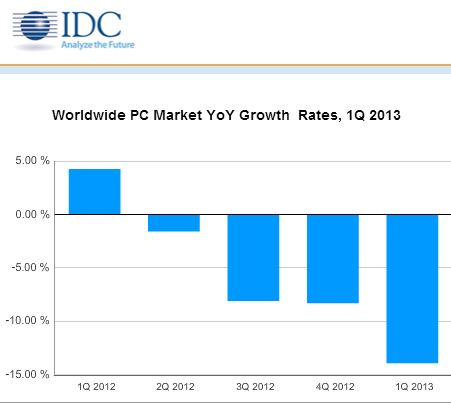

So now that we’ve taken a turn at putting a positive spin on the decline of PC sales, what does IDC claim is the damage? Per IDC’s latest and just released Worldwide Quarterly PC Tracker report, worldwide PC shipments totaled 76.3 million units in Q1 2013 - down 13.9 percent year over year. However, IDC had forecast a decline of only 7.7 percent so the industry took a hit almost double IDC’s expectations. This is the fourth consecutive quarter of year-on-year PC shipment declines.

IDC further notes that this is the single greatest quarterly decline since it began tracking the PC market on a quarterly back in 1994. The chart below provides year over year details.

The most recent quarter was supposed to offer a “glimmer of hope” to the industry, because Windows 8 would finally be completely in the pipeline, and numerous new designs and models built around lightweight, touchscreens and generally quite impressive specs (no tablet can hold a candle to laptop performance on paper) would now be available.

Alas, all of these things came to pass but none of these things made a difference. Nor will these things make a difference. Nor are we surprised.

That’s simply what happens when an entire ecosystem enters a final stage of equilibrium. We fully expect that PC shipments will eventually stabilize and remain stable for a substantial period of time before they begin their final decline and they disappear entirely – sometime in the 2020s is our guess.

We aren’t in the least understanding why IDC thought the decline would be half of what it turned out to be. The lure of the tablet is simply too great. The model has become one of “live with the PC that is already more powerful than you need it to be” and get one of the new toys that offer a significant value add – not in computing power but in inherent mobility. Our own personal toys certainly reflect this strategy.

PC Sales in the Enterprise

What we would be very interested to know is how the sale of PCs is progressing in the enterprise. Even here, where added performance, lighter weight and touchscreens in a laptop configuration will in fact matter, we would expect to see declines, though not nearly as severe as the overall market that includes the pure consumer segment.

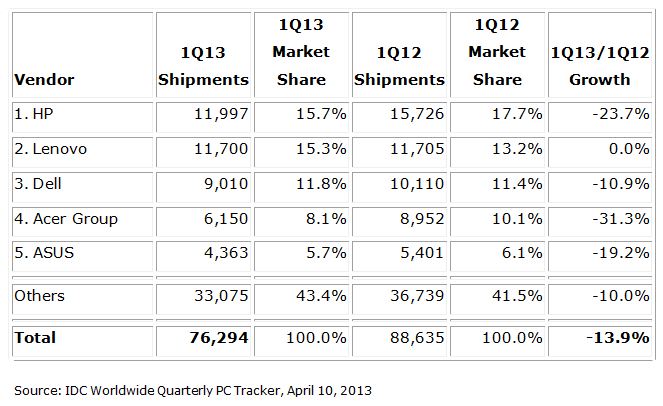

Lenovo, which focuses a great deal and in fact most of its attention on the enterprise, is doing much better than the other big players here – especially when compared to the downtrodden Dell an HP.

There is a reason for this – the enterprise focus.

The overall PC sales drop has been consistent across all global regions. Whether the reason for this is to be found in tablets or ongoing budget and economic pressures, or more likely a combination of both, all countries have been affected.

The U.S. market – which is by far the largest for PCs at every price point – was down 12.7 percent year over year, and the drop compared to Q4 2012 was even worse, down 18.3 percent. Total volume fell to 14.2 million, which represents the lowest quarterly shipments since Q1 2006. With the exception of a 2-percent growth “spurt” in Q3 2011, the United States has now recorded 10 consecutive quarters of year-over-year market contraction.

Again, we would be very interested to see how enterprise PC sales compare to consumer sales. The chart below points to PC shipments for the top five vendors in the U.S.

The numbers speak for themselves, but we need to point out two things. First, Dell’s global numbers were less severe than we might have anticipated. Second, Lenovo’s numbers are particularly worth noting. Simply by managing to keep sales flat (due primarily to some sales decline outside of the United States), Lenovo continues to outpace the market overall – and by a wide margin.

Though we haven’t shown the U.S.-only chart, Lenovo posted the only sales gain in the United States – 13 percent; this was offset by 13 percent in declines overall in all other regions for the company. As we noted above, we believe Lenovo’s market strength relative to its competitors is entirely due to Lenovo’s strong enterprise focus. Look to Lenovo to continue to outpace its competitors.

The decline in PC shipments does have potentially significant ramifications for parts suppliers worldwide. Are tablet sales enough to offset what the global tech parts supply chain? We’re not sure, but we suspect they are.

So then is the PC industry truly in a state of decline or is it an ecosystem rapidly coming into equilibrium against new technologies and market realities? We believe it is the latter.

Edited by

Braden Becker  QUICK LINKS

QUICK LINKS