Earnings season is in full bloom this week, and throughout the day yesterday we had Microsoft, IBM, Google and Nokia to thank for some interesting numbers. Verizon Wireless was also there with earnings today but at this point in time the one that we are really interested in, especially from a mobile perspective, is Microsoft.

Our colleague Doug Barney ran down Microsoft numbers, and we'll leave it to Doug to for the larger picture analysis. We're going to take a look at how the mobile end of things ended up working for Microsoft this quarter. Doug also ran down IBM's numbers for those who are interested, and we've provided Nokia's earnings as well.

We include pointers to them here for some general perspective relative to Microsoft's earnings.

In any case, there continues to be a lot of noise circulating about - most recently driven by Gartner and IDC reports that the PC industry is shrinking so quickly that to read most headlines reminds us mostly of the Titanic going down in the final 20 minutes, with Leonardo DiCaprio and Kate Winslet holding on for that last moment before the final deep plunge.

And yet the PC industry will still sell over 300 million new PCs in 2013. That points to a market that will no longer grow but that we nevertheless believe will stabilize and continue to deliver a very viable marketplace. Can Microsoft grow in such an environment? That is the key question.

Today's earnings results suggest that the answer is a likely…probably.

The first thing to keep in mind is that the fiscal Q3 2013 revenue and profits Microsoft reported include dollars that were deferred from being reported earlier due to the timing of Microsoft's various releases toward the end of 2012. This includes Windows 8, Windows RT and the Surface tablets - more specifically, its Windows Upgrade Offer, Office Upgrade Offer and Pre-Sales, and its Entertainment and Devices Division Video Game Deferral.

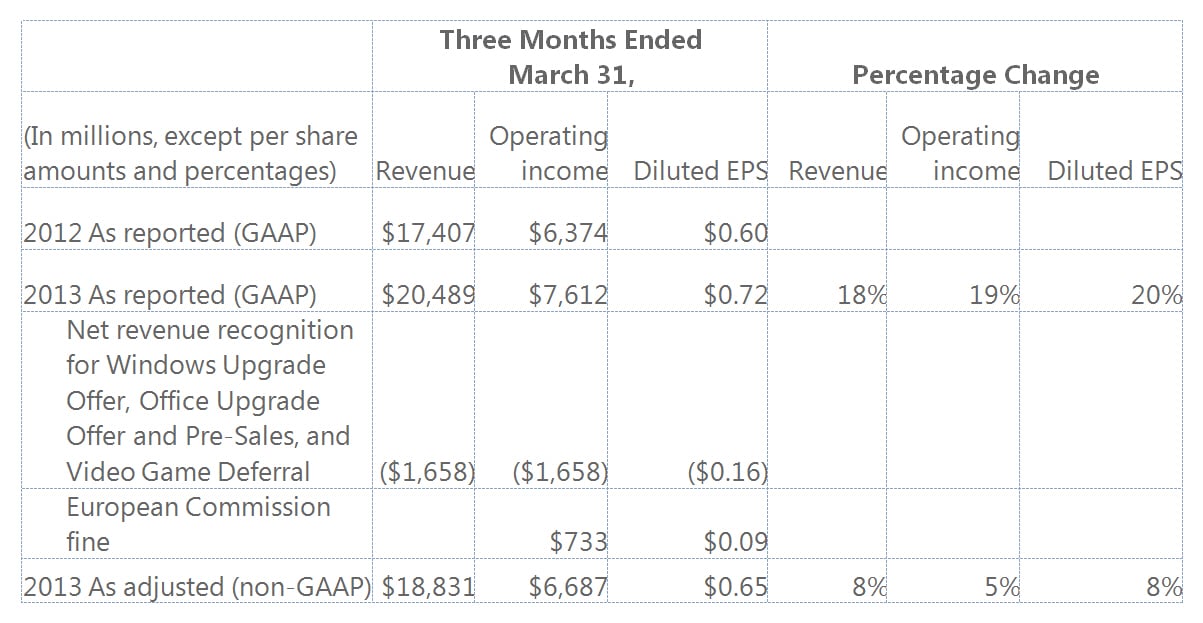

There was a negative offset to these dollars because of a $733 million European Commission fine (we'll leave details on this fine out of our discussion). The chart below puts these key numbers in perspective - the non-GAAP numbers suggest what the quarter would have looked like without the deferred dollars.

Year over year, the company still beat out its Q3 2012 numbers despite the "plunging fortunes" of the PC industry. As we pointed out in our article on PC market dynamics, when the pure and very low margin consumer market is factored out of the equation, the enterprise market more than holds up its end for Microsoft.

The company's COO, Kevin Turner, underscores this; “Our enterprise business continues to thrive. Enterprise customers are increasingly turning to Microsoft for their IT solutions and as a result, we continue to take share from our competitors in key areas including hybrid cloud, data platform, and virtualization.”

Generally speaking, revenue from Windows itself remained unchanged year over year - in a declining PC market one might have expected Windows revenue and income to decline, but based on the deferred numbers this did not prove to be the case. Although Microsoft did not utter a single word to suggest how its Surface tablet sales are doing, it is a reasonable assumption to make that the new mobile device hardware played a strong role in at least ensuring that the gap between a declining PC market and overall Windows revenue remained zero and flat.

We also need to factor in that the Surface tablets - especially the Surface Pro - are still quite new to the market. The enterprise world has yet to really begin driving Surface Pro sales, but we absolutely believe that over the next several quarters this will in fact happen. The fiscal Q3 2013 numbers strongly suggest Microsoft is making solid headway in ensuring that inevitable PC sales declines are offset by other revenue streams.

This is the business world's natural order of things - and all indications point to Microsoft successfully adapting to inevitable change.

Most sensationalist headlines miss this most critical issue - headlines prefer to gravitate towards such things as "PC market implosions " and "lackluster Windows 8 sales." They make the business world sound utterly simple, but in fact it is entirely complex - and Microsoft continues to successfully navigate this complexity.

The problem of course is that while this thrills value investors, those looking for the next big thing will find little to cheer about. Windows Phone 8 and the Surface tablets, for example, represent Microsoft "adapting" - they do not represent revolution or change in the sense that the iPad and iPhone delivered. Even Xbox and Kinect are evolutionary adaptations. Microsoft has $75 to $80 billion in established full year revenue it needs to protect - and it has done so with a great deal of adaptation skill.

It is what Steve Ballmer is exceedingly good at.

Out of the Blue

What Ballmer is unable to do is to find the next "new, new" thing. Nor is he ever going to - he's handcuffed by his desire and need to protect the existing revenue streams. Adaptations - more accurately evolutionary adaptations - are the way to accomplish this. He will safely keep Microsoft moving ahead with 4- to 6-percent yearly growth, but there will be no new $20-billion business to add - and that is what is needed for Microsoft's stock to become a player again.

The next Windows - code named Windows Blue - is absolutely another evolutionary adaptation of Windows. It may very well include the return of the Start button and "optioning rather than requiring" the use of the current touch interface. And perhaps Microsoft will create an environment of constant operating system updates - moving away from three to four year monolithic upgrades is yet another adaptation - it isn't a revolution! We'll see how it goes.

One thing we know for certain is that Microsoft will continue to successfully deliver on the revenue, net income and huge cash piles.

Do we wish Ballmer was the company's COO instead of its CEO? Yes, we emphatically wish that was the case. Being handcuffed to adaptation rather than revolution is Ballmer's fate - which is well-suited to a COO, and Microsoft can never be anything other than adaptive with Ballmer at the helm.

But let's not fool ourselves that any CEO would have an easy time of finding the next stock-changing $20-billion business for Microsoft. We need to remember that Steve Jobs inherited a totally broken company - unlike Ballmer, Jobs had nothing to lose and certainly nothing to protect in taking Apple in revolutionary directions.

Revolution will be an enormous, daunting and very likely unbeatable challenge no matter who the next Microsoft CEO might be.

That brings us around to our Microsoft earnings conclusions. Yes, all the enterprise business adaptations (Office, cloud, back end systems, etc.) continue to thrive, and the online and gaming adaptations are kicking in their share and will continue to grow. But for Windows, it is the mobile end of things that will prove to be the adaptation that keeps Microsoft moving forward. Microsoft had too many mobile miscues and was too late to the game, but is clear to us that the new mobile devices, while not headline-grabbing entities (other than for occasional sensationalist speculating about doom and gloom), will nevertheless make the necessary contributions to keep Microsoft moving safely ahead.

Value investors can cheer - and cheer loudly. Those among us looking for massive growth opportunities and skyrocketing stock prices will need to look elsewhere.

Edited by

Braden Becker  QUICK LINKS

QUICK LINKS