At the very beginning of April 2013, Kantar Worldpanel ComTech released research that more or less pointed to BlackBerry withering on a dying global vine. The company is now back with additional research, this time pointing to Windows Phone 8 (WP8) apparently having some success developing roots from which to grow its own mobile operating system and mobile device vine.

It's hardly a surprise that WP8 would begin to show some traction. We believe that 2015 will be a much more interesting time frame for measuring WP 8 success, but it is nevertheless encouraging seeing some early growth.

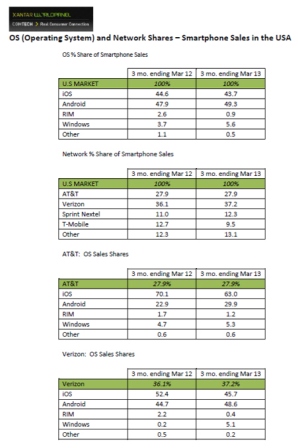

The data for the report comes through Kantar Worldpanel ComTech USA’s consumer panel. According to Kantar, WP8 accounted for 5.6 percent of smartphone sales as Q1 2013 came to a close. As shown in the chart below, the operating system gained 1.9 percent year over year with Q1 2012.

This is a larger percentage gain than Android posted for the same time period. With 49.3 percent of U.S. smartphone sales, Android remains the top selling operating system overall, but it only grew 1.4 percent compared to the same period last year. iOS declined slightly to 43.7 percent of smartphone sales, down 0.9 percent year over year. These numbers suggest very little movement in the respective positions of Android and iOS, but we need to note that it was a quarter with nothing new going on.

Samsung - the primary driver of Android - is just now getting ready to put its new flagship Galaxy S4 into the U.S. market, and there will be nothing new from Apple until at least early June, when we expect to hear a great deal about Apple's immediate and future plans. In any case, we can expect Android to pick up a few more percentage points in Q2 2013, again at the expense of iOS. But WP8 devices should continue to show growth.

Currently the Kantar numbers suggest that WP8 gains are coming at the direct expense of BlackBerry, which has not caught fire in the U.S. As Kantar's earlier report we highlighted above also shows, BlackBerry continues to lose steam more or less in every global region. In the future, WP8 market share will have to start coming at the expense of, we believe, Android.

Nokia will be announcing a new flagship product on May 14, 2013, which of course will be a WP8 device, but the company is also anticipating making inroads with new lower end WP8 phones that were not in the market in Q1 2013. Though not shown in the chart, Nokia is only at four percent market share for all smartphones sold in Q1 2013 - but, and this is a non-trivial but - Nokia has in fact seen its share of the market rise from just one percent for the same quarter a year ago. We anticipate Nokia continuing to make such modest gains, and also expect that Nokia is likely to show more solid growth beginning in 2015.

As the chart above shows, the Kantar report also examined the top wireless communications vendors for their overall contributions. The numbers speak for themselves, and as we would expect, there hasn't been much change - it is a more or less status quo scenario.

We do note that T-Mobile actually lost some share, but the report measures performance prior to T-Mobile's new launch through its "un-carrier" campaign - which will see the company try to gain back market share with unsubsidized smartphone deals and no-contract pricing options. We should begin to see some movement in Q2 2013 though the next quarter will likely be a better indicator of T-Mobile's likely trajectory.

Kantar Worldpanel ComTech analyst Mary-Ann Parlato notes that, “Windows strength appears to be the ability to attract first time smartphone buyers - those upgrading from old feature phones. Of those who changed their phone over the last year to a Windows smartphone, 52 percent had previously owned a feature phone. Comparatively, the majority of iOS and Android new customers were repeat smartphone buyers, with 55 percent of new iOS customers, and 51 percent of new Android customers coming from another smartphone."

It is an interesting insight. Though one would likely be wrong if asked to guess - especially given all the marketing hype surrounding smart phones, the truth of the matter is that more than 50 percent of the U.S. market still uses a feature phone. This scenario bodes well for both Nokia and Microsoft. The next several quarters should demonstrate ongoing WP8 growth.

We'll also note that Windows 8 - whether slow moving or not, will eventually begin to make its way in huge numbers into the overall enterprise, and we believe that a great deal of enterprise IT will begin to find that using WP8-based smartphones within the enterprise will prove a very attractive scenario. As we noted earlier, there is no rush for this to happen - we project 2015 as the first real year for WP8 to show its real market strengths (or conversely, to show its lack of market strength) - until then look for a slow and steady increase in market share regardless, likely at the expense of Android.

We certainly don't anticipate WP8 taking up market share from iOS - especially if Apple delivers on a new wave on innovation later this year.

Edited by

Alisen Downey  QUICK LINKS

QUICK LINKS