A new iHS report shows that the second quarter revenue for mobile dynamic random access memory (DRAM) in 2013 rose by 26 percent. The numbers show that Q1 reported $2.2 billion in revenue and Q2 rose to $2.8 billion. The first quarter was listed as dismal because mobile DRAM revenue fell by 14 percent.

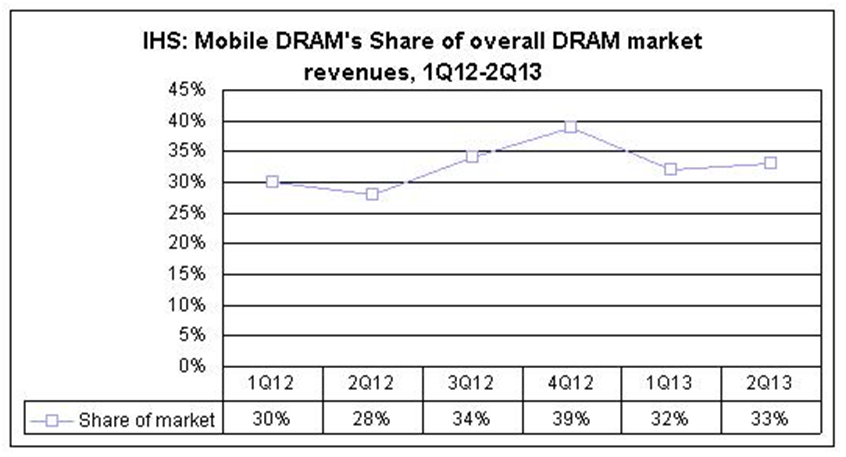

The report also shows that while revenue did increase by more than a quarter, the mobile DRAM share of the DRAM market only rose by what can be considered a sliver coming in at one percent. The first quarter represented 32 percent, while the second quarter came in at 33 percent.

According to Mike Howard, senior principal analyst, DRAM & Memory, for HIS, "Share of mobile DRAM remained below the levels reached in the second half last year because of seasonally slow demand during the most recent period for smartphones and tablets. In this respect, commodity PC DRAM continues to account for the majority of the DRAM space with the rest of the DRAM market represented by other segments, such as server DRAM, consumer DRAM and graphics DRAM."

The iHS report indicates that global revenue for mobile DRAM reached $2.6 billion in a two month period between April and May. The growth was driven by a 24.1 percent increase in mobile DRAM bit shipments. In addition, a 1.5 percent increase in average selling prices (ASP) also contributed.

Although the mobile DRAM increase in the second quarter was less than two percent, iHS doesn’t see this as a trivial matter. It appears that the increase, as small as it may seem, was a departure from something like the last nine quarters. That two plus year period has shown consistent pricing declines.

It is possible that forecasted demand for smartphones and tablets in the second half of 2013 should represent continued growth of the mobile DRAM market. The demand for mobile DRAM is expected to heat up due to the fact that we will be seeing new smartphones and tablets launch before the holiday season.

It should come as no surprise that South Korea remains the dominant force for mobile DRAM. It controls almost three quarters of revenue. South Korea can thank the heavy hitters Samsung and SK Hynix. Although Samsung’s share dropped by two percentage points, it still has twice the market share of SK Hynix.

Coming in at the third spot was Elpida Memory of Japan, with Micron Technology of the U.S. coming in a low fourth. What is interesting about these two spots is that Elpida has been acquired by Micron Technology.

This is a case where the acquired performed much better than the buyer for the period. Elpida's mobile DRAM revenues in the second quarter jumped 80 percent from year’s levels, while Micron underperformed the market with revenue growth of only 17.6 percent, IHS said. Elpida had 20.5 percent market share in the second quarter, while Micron was a distant fourth with just 3.9 percent.

The following chart gives you an indication of the fluctuation between 2012 and 2013 (click to enlarge):

Source: IHS, compiled by Digitimes, September 2013

Edited by

Alisen Downey  QUICK LINKS

QUICK LINKS