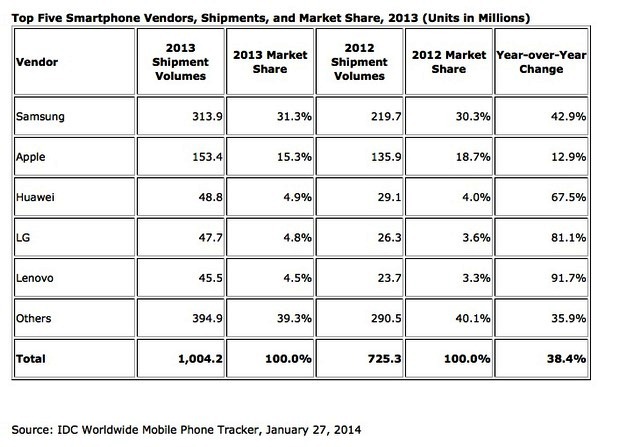

Samsung is the leading vendor as the world’s smartphone population exceeds one billion. The actual figure estimated by the International Data Corporation (IDC) is that there are about 1.0042 billion smartphones out in the world. This number relates to a 38.4 percent increase over the shipment numbers for 2012. There were 725.3 million units shipped in 2012.

This also represents another milestone reached in the global smartphone market. The information comes to us by way of IDC’s report entitled “Worldwide Quarterly Mobile Phone Tracker.” This report provides total market size and vendor share.

IDC was only slightly off with its predictions for last year. The number that IDC saw was 1.0104 billion smartphone shipments. The firm was only off by less than one percent. Smartphones accounted for 55.1 percent of all mobile phone shipments in 2013. This is up from the 41.7 percent of all mobile phone shipments in 2012. In the fourth quarter of 2013 vendors shipped a total of 284.4 million smartphones worldwide. This is an increase of 24.2 percent from the 229.0 million units shipped in 4Q 2012.

Some of the vendor highlights from IDC’s report reads as follows:

- Samsung ended the quarter the same way it began the year: as the clear leader in worldwide smartphone shipments. But even with sustained demand for its Galaxy S III, S4, and Note models, as well as its deep selection of mid-range and entry-level models, the company realized a decline compared to the previous quarter. Nevertheless, the company maintained a sizable double-digit lead over the next vendor.

- Apple posted record shipment volume during 4Q13, driven primarily by the addition of multiple countries offering the iPhone 5S and 5C, and sustained demand from its initial markets that saw these models launch at the end of 3Q13. Still, Apple had the lowest year-on-year increase of all the leading vendors. Now that Apple has finally arrived at China Mobile, it remains to be seen how much Apple will close the gap against Samsung in 2014.

- Huawei maintained its number three position worldwide, attained the highest year-on-year increase among the leading vendors, and raised its brand profile with a higher proportion of self-branded units compared to the ODM work it had done for other companies. Still, even with its success, Huawei faces a crowded group of potential competitors within striking distance.

- Lenovo, despite having no presence in North America nor Western Europe, finished the quarter in the number four position. The company's strength lies in its strong presence within key emerging markets and a well-segmented product portfolio spanning from simple, affordable smartphones to full-featured 5" screen models. Should the company become successful at branching into more developed markets in 2014, it could challenge Huawei for the number three spot.

- LG finished just behind Lenovo and edged out ZTE for the number five position, with just five million units separating the two companies. At the same time, its year-on-year improvement put the company on par with Huawei and Lenovo with market beating growth. LG's success can be directly attributed to its revived portfolio from a year ago, which featured more large-screen and high-end models, including the Nexus 5 and its Optimus G series.

Ramon Llamas, who is research manager with IDC's mobile phone team, said "The sheer volume and strong growth attest to the smartphone's continued popularity in 2013. Total smartphone shipments reached 494.4 million units worldwide in 2011, and doubling that volume in just two years demonstrates strong end-user demand and vendor strategies to highlight smartphones."

Ryan Reith, the program director with IDC's Worldwide Quarterly Mobile Phone Tracker, said "Among the top trends driving smartphone growth are large screen devices and low cost. Of the two, I have to say that low cost is the key difference maker. Cheap devices are not the attractive segment that normally grabs headlines, but IDC data shows this is the portion of the market that is driving volume. Markets like China and India are quickly moving toward a point where sub-$150 smartphones are the majority of shipments, bringing a solid computing experience to the hands of many.”

The following chart shows a breakdown of the top five smartphone vendors:

Edited by

Cassandra Tucker

QUICK LINKS

QUICK LINKS