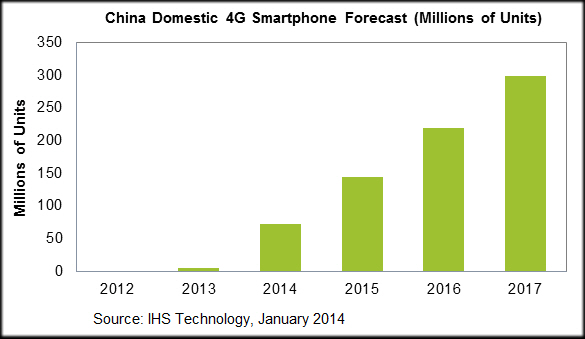

Here's good news for Apple, and a confirmation of what we already pretty much know - the 4G smartphone market in China will be - is already - enjoying unstoppable growth. Shipments are now forecast by IHS Technology to jump to 144.1 million units in 2015, followed by a 53 percent jump to 219.8 million and eventually reaching 298.5 million units by the end of 2017 - a 16X jump from overall sales in 2013. The numbers come from the China Electronics Supply Chains service of HIS, in its new report, China Smartphone Market Enters 4G Era.

Shipments of 4G smartphones in 2014 alone within China are now forecast by IHS to reach 72.4 million devices from just 4.6 million last year - a nearly 1,500 percent jump. The high-end 4G smartphone market will make up close to 40 percent of the entire 4G space in China this year, IHS predicts. IHS further predicts that the market will likely take off after the second half of the year.

Those kinds of growth numbers for 2014 would suggest that we will see some heady device sale numbers not only from Apple and Samsung but likely from the other larger vendors as well, which includes Nokia. We'll come back to the Chinese manufacturers in a bit.

Clearly this 4G smartphone growth marks a real changing point not only for China, but for overall global growth, as the China numbers are significant enough to tweak the global 4g growth curve. Keep in mind that China is starting this growth from a practically nonexistent base a mere two years ago. The numbers clearly suggest as well that Apple has timed its China Mobile deal perfectly, and that as we've noted elsewhere, in makes 2014 the perfect year as well for Apple to bring larger display iPhones into the market.

Both Apple and Samsung should see some heady "overall" growth in sales based on China. For the first half OF 2014 IHS suggests that the 4G smartphones will be popular in China include Samsung's Note 3 and the iPhone 5s. IHS expects Apple will sell more than 20 million iPhone units in China this year but a larger display device may tilt that number even higher.

Kevin Wang, director for China research at IHS further points out the importance of LTE in saying, "With support from the government and increasing clamor from the public, 4G smartphones will be the new hot market in China. Already Beijing has granted licenses for TD-LTE, China’s homegrown version of the 4G Long Term Evolution standard, to the state’s three carriers. This way, China Mobile, China Telecom and China Unicom can all launch commercial 4G services whenever they wish." Apple, as we've noted over the last 8 months, has built its China Mobile deal around being able to tap into TD-LTE with the same iPhones it sells globally - this was a key to getting the China Mobile deal done.

Below is a chart that shows the growth path for 4G in China:

We need to keep in mind that as heady as the numbers in the chart above are, it is in fact just a small percentage of the overall smartphone market for China, representing only 19 percent of all smartphones that will be sold in China in 2014 - forecast by IHS to be 371.8 million. 3G-only smartphones will continue to make up the majority of sales this year with 290.3 million units, up one percent from 287.2 million in 2013. There will also be plenty (albeit rapidly declining) numbers of old 2G mobile devices in the mix as well.

The Smartphone Manufacturer Mix

Regardless of how well Apple, Samsung and potentially Nokia will do, the overall Chinese smartphone market will still be primarily controlled by the major domestic manufacturers - which include, of course Huawei Technologies, Lenovo and ZTE. Most of us would have guessed these are the top three - there are no surprises here. IHS suggests that the new "stars" in 2014 will be Xiaomi, OPPO and vivo.

The Chinese manufacturers owned 70 percent of shipments in China in 2013, with more than 50 percent of sales controlled by China's top ten vendors. Huawei remained the top smartphone vendor in 2013 with more than 50 million devices sold, followed by Lenovo at 44 million and ZTE with 40 million. ZTE is worth keeping an eye on as it is among those vendors most likely to make use of alternative mobile operating systems such as Firefox Mobile and Ubuntu Touch.

As is still the practice in the United States, the cost of smartphones is and will continue to be heavily subsidized by the Chinese carriers. It is necessary to do so in order to persuade consumers to buy new handsets and to seed the market for them. High-end smartphone models can go for more than 3,000 renminbi (roughly $500) - so subsiding higher end smartphone costs is necessary, at least in the short term.

In 2013 the three operators spent a total of 27 billion renminbi (approximately $4.5 billion) in subsidies for 3G smartphones, up 10 percent over 2012. Though this clearly hurt net income for all three Chinese carriers, it is a necessary investment the carriers need to make in order to ensure the market remains sustainable and grows.

Interestingly, there is an active underground gray market for China-made handsets though IHS notes it is on the decline following active government intervention to kill it. The gray market for such handsets is considered illegal by authorities. IHS suggests that this market will decline to 183 million devices this year, down from 200.3 million in 2013.

All in all, 4G and LTE will clearly thrive in China, just as it now thrives everywhere else. In the end China's mobile users will all benefit.

Edited by

Cassandra Tucker

QUICK LINKS

QUICK LINKS