The last few days leading up to the just announce iPhone 5 have been filled with product introductions from the Android Nation seeking to take some wind out of Apple’s sails and sales. While focus has been on device sizzle, lost in the hoopla has been the possible/probable havoc the proliferation of these LTE devices will have on wireless networks.

For those who follow my postings, you know I have been an unashamed booster of paying attention to not only the data storm the proliferation of next generation smart devices will generate as they exploit new functionality and apps, but also the signaling data storm that needs to be dealt with so the user experiences for all those toting their new personal communicators are compelling.

What has been interesting is that quantification for what the future looks like based on the explosive sales of new devices, coupled with the rapid deployment of LTE networks, has been limited. That is until today with the release by the Global Mobile Suppliers Association (GSA) of their latest survey of LTE deployments, and the release by Diameter signaling leader Tekelec of the new Tekelec LTE Diameter Signaling Index™ — the first ever look at the global signaling storm heading directly at wireless service provider networks.

Before getting into some of the details, just looking at the Index from a high level is illustrative that what is coming is big. Tekelec is predicting Diameter signaling traffic growth will more than triple mobile data traffic growth through 2016. It forecasts that Diameter Messages per Second (MPS) will increase to 47 million Diameter MPS by 2016, representing a compound annual growth rate (CAGR) of 252 percent between 2011 and 2016.

A useful tool for industry executive, network architects and engineers

As Tekelec points out, the Index is an industry first. It goal, like such indexes that look at traffic in the data networking world, is to help business executives, network architects and engineers forecast Diameter signaling traffic growth associated with:

· Policy management which intelligently orchestrates the subscriber experience

· Communications among policy servers, charging systems, subscriber databases and gateways; d

· Mobility management functions, including subscriber authentication onto networks and roaming between partner networks

The Index provides guidance on how data sessions, video streaming, voice over LTE (VoLTE), and sophisticated policy and charging rules impact Diameter signaling traffic growth. It calculates LTE Diameter MPS based on assumptions relevant to LTE services such as third party LTE subscriber forecasts, subscriber usage, the number of active subscribers, the number of concurrent sessions, mobility busy hours, subscriber busy hours, policy sessions and online and offline charging interactions.

In addition, 3GPP and GSM Association standards and documentation are used to establish Diameter traffic profiles based on service type. And, possibly the most valuable tool associated with the Index is the incorporation of this information into the Tekelec Diameter Signaling Index Calculator™ which allows service providers to forecast Diameter signaling traffic growth on their LTE and 3G networks.

As a package the Index along with calculator provides a traffic demand model and serves as a reference point from which service providers can layer on critical factors such as network architecture, topology, capacity requirements, geo-redundancy and other implementation-specific factors that are needed to architect a robust, reliable and scalable Diameter Network.

A look at the forecasts

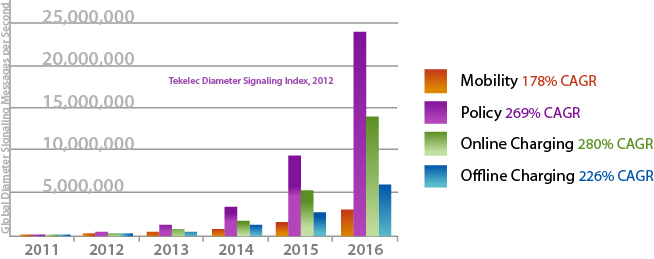

This is a case where if a picture is worth a thousand words, then two are some multiple. The first figure is of considerable interest is because it shows the growth in traffic by message type. While the tendency would be to just look at the mobility area, it is critical to acknowledge the even faster growth in the policy and charging areas since these go to the heart of providing new user experiences and the move to usage-based pricing and things like multiple devices and people sharing data plans.

* Source: Tekelect LTE Diameter Index™: Forecast Report and Analysis 2011- 2016

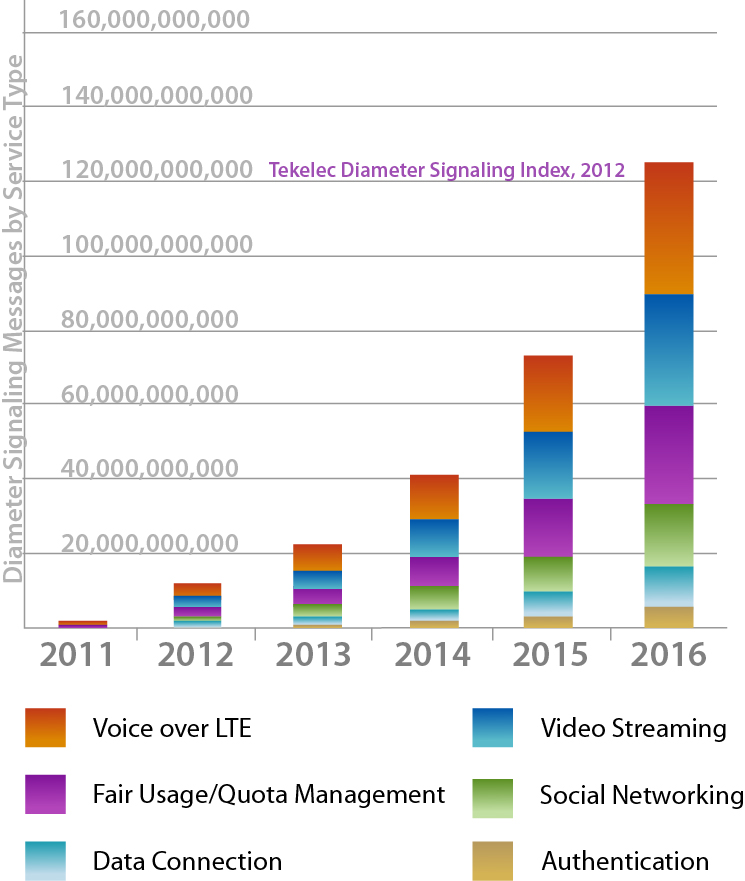

Equally as interesting are the forecasts by service type in the next graphic. The acceleration of LTE deployments and the expected increase in VoLTE, along with what everyone believes will be an explosion of both real-time videoconferencing, interactive gaming and increased streaming are the big drivers here.

* Source: Tekelec LTE Diameter Index™: Forecast Report and Analysis 2011- 2016

The real story here is that all of those apps on all of those devices that are running in the background or are just one open process of several concurrent sessions all are signaling intensive. And, just think of the additional signaling caused by people roaming in the traditional sense or roaming as in switching between macro-cellular connections and WiFi ones.

A summary of the key findings from the above includes:

- Policy has the largest impact on total Diameter signaling traffic with nearly 24 million MPS crossing LTE networks by 2016 in support of policy use cases —a CAGR of 269 percent over the 2011-2016 period — based on the growth of sophisticated data plans, personalized services, and over-the-top (OTT) and advertising models.

- Online charging is the largest area of growth for Diameter signaling MPS as service providers migrate their charging networks to all IP-based architectures — forecast to increase from nearly 18,000 MPS to nearly 14 million MPS by 2016, for a CAGR of 280 percent.

- Subscriber authentication will generate 5.4 billion messages in 2016. Social networking activity is forecasted to spike from about 155 million Diameter messages in 2011 to 17 billion in 2016.

- As mentioned, VoLTE and video streaming will sharply increase Diameter signaling with about 36 billion and 30 billion Diameter messages, respectively, in 2016 — generating high amounts of Diameter signaling due to Quality of Service (QoS) requirements.

- The growth in Diameter signaling traffic directly correlates with innovative LTE services and new business models, such as:

o Rate plans based on usage, quality of service, application and time of day

o Mobile cloud services

o OTT application services such as video and social networking

o Machine-to-Machine (M2M) services

o Mobile payment and advertising services

Diameter signaling growth by geography

- North America: Diameter signaling traffic will rise to 15.9 million in 2016, for a 216 percent CAGR. North America will be the largest contributor to global Diameter traffic through 2015.

- Asia-Pacific (APAC): Diameter signaling traffic will rise to 16.7 million MPS in 2016, for a 263 percent CAGR. APAC will lead the world in Diameter MPS starting in 2016.

- Europe, Middle East & Africa (EMEA): Diameter signaling traffic will rise to 13.8 million MPS in 2016, for a 320 percent CAGR.

- Caribbean & Latin America: Diameter signaling traffic will rise to nearly 540,000 MPS in 2016, for a 962 percent CAGR. A sharp rise in LTE subscribers is expected in the region beginning in 2013.

This is not surprising based on known LTE rollouts around the world and the expectation that the hotly competitive North American market has the most early need, especially given the LTE device wars that are now fully underway.

Taking note of the findings, Doug Suriano, chief technology officer, Tekelec stated: “Diameter signaling growth is more dramatic than mobile data traffic growth. The rise is steeper, the time to plan for it is shorter and there are no offload solutions like there are for data traffic. But here’s the good news: service providers now have a way to forecast Diameter signaling traffic on their LTE networks. This is critical because an increase in Diameter signaling means an increase in personalized services, higher revenues, and happier customers.”

Are the networks ready?

Good question with a somewhat ambiguous answer. We are still early in the deployment of LTE networks around the world, particularly those that support VoLTE, which means the timing for service providers to take advantage of the information in the Index is propitious.

In fact, Mike Thelander, CEO of Signals Research Group feels that: “Unlike the ongoing 3G signaling storm which is being created by smartphone-based applications and social networking services, the eminent Diameter signaling phenomenon can also have positive implications in the form of new revenue-generating opportunities for service providers and differentiated service offerings for subscribers. The industry, however, first needs to fully understand and appreciate the Diameter signaling implications associated with various policy control and enforcement initiatives, new services, such as VoLTE and M2M, not to mention the underlying network architecture.”

In discussing the release of theTekelec LTE Diameter Signaling Index™ with Travis Russell Tekelec technologist, strategic marketing leader and Joanne Steinberg, director, strategic marketing broadband network solutions, they each were highlighted the value of the Index based on how it was created and how it can be used.

Russell noted that, “the modeling done here was unique because it looked at the device and behavior of the device in the network and looked at use of network service types meaning the numbers are based not on an assumed presumption of growth but on a good view of subscriber behaviors.” Steinberg added that: “as a result of all apps generating Diameter traffic be they native or in the cloud, they are constantly interacting. And, the shift to usage-based plans means exponential increases in communications with policy servers, billing systems and subscriber databases. All of this needs to be modeled and planned for and managed centrally because at the end of the day the Diameter signaling function rests at the foundation of enabling user experiences that delight customers and are central to the implementation of new billing scenarios, particularly as the world goes all IP.”

Tekelec says the interest from customers around the world in the process of executing their LTE plans has been strong for their products and services. They also stated that in their socialization of the Index that interest has been intense in terms of having well-reasoned information that allows them to put metrics and parameters on what they are looking at in the not too distant future.

Back to the question of readiness, the answer is not ready yet, but capable of being ready in time to prevent the types of network outages and throttling that has already been experienced as a result of previous signaling storms.

The Index is a snapshot that will be updated periodically. Tekelec says that its forecast should be viewed as being conservative. It will be fascinating to see if this conservatism is reflected when the updated Index is produced, given the pace at which new devices are purchased, activated, put on usage plans and start downloading apps and using more video, and how fast competitive imperatives drive LTE deployments. For this moment in time, a tip of the hat to Tekelec is extended to Tekelec for providing this first view on what typically is a critical area of the industry where light does not shine often when it really should.

Want to learn more about today’s powerful mobile Internet ecosystem? Don't miss the Mobility Tech Conference & Expo, collocated with ITEXPO West 2012 taking place Oct. 2-5 2012, in Austin, TX. Stay in touch with everything happening at Mobility Tech Conference & Expo. Follow us on Twitter.

QUICK LINKS

QUICK LINKS